Jeremiah Shelor joined NGI in 2015 after covering business and politics for The Exponent Telegram in Clarksburg, WV. He holds a Master of Fine Arts in Literary Nonfiction from West Virginia University and a Bachelor of Arts in English from Virginia Tech.

Archive / Author

SubscribeJeremiah Shelor

Articles from Jeremiah Shelor

More Weather-Driven Demand, Lower Production Lifts Natural Gas Futures

Further demand gains in the weather outlook and reports of supply disruptions helped inspire a natural gas futures rally to open the work week Monday. In the spot market, hotter temperatures supported Southeast gains, while price moves were mixed in the West; the NGI Spot Gas National Avg. added 6.0 cents to $2.125/MMBtu.

Natural Gas Futures Rally Early on Record Southeast Heat, Supply Cuts

Natural gas futures rallied early Monday, boosted by a combination of May heat and supply cuts. The June Nymex contract was trading 5.3 cents higher at $2.684/MMBtu shortly after 8:30 a.m. ET.

Heat on the Way, But Natural Gas Futures Stuck in Neutral

Near-term forecasts calling for a mix of heating and cooling demand across the U.S. Lower 48 coincided with a mix of spot price trends Friday; the NGI Spot Gas U.S. National Avg. fell 9.5 cents to $2.065/MMBtu.

Market to ‘Move Toward Balance’ Over Summer; June Natural Gas Called Higher

Natural gas futures were trading slightly higher early Friday, with the overnight forecasts still pointing to above-normal weather-driven demand for next week. The June Nymex futures contract was up 1.4 cents to $2.653/MMBtu shortly after 8:30 a.m. ET.

Natural Gas Futures Rebound as Heat Approaches

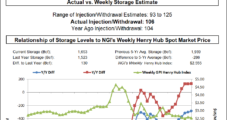

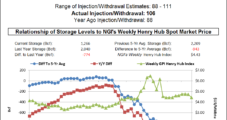

U.S. natural gas futures rebounded Thursday as traders brushed off government storage data that continued the recent run of above-normal inventory builds. In the spot market, prices mostly pushed lower, with the largest declines recorded in California, West Texas and the Northeast; the NGI Spot Gas National Avg. dropped 5.0 cents to $2.160/MMBtu.

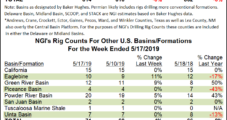

BHGE’s U.S. Rig Count Eases on Declines in Oil Patch

The U.S. rig count held steady for the week ended May 17, dropping one unit overall to fall to 987, although major plays, including the Permian Basin and Marcellus Shale, saw larger net declines, according to data from Baker Hughes, a GE Company (BHGE).

Two Natural Gas Rigs Rejoin U.S. Patch; Oil Count Drops

Two natural gas rigs returned to work in the United States during the week ended May 17, while the domestic oil patch continued to thin its ranks, according to data from Baker Hughes, a GE Company (BHGE).

Natural Gas Futures Mostly Unchanged as Heat Looms, Stocks Build

The natural gas futures market spun its wheels Friday, with traders stuck mulling the prospect of summer demand growth on the one hand and recent bearish storage builds on the other.

Weekly Natural Gas Spot Prices Mixed as Heat Creeping Into Lower 48

Warm and cool springtime conditions kept natural gas spot price action decidedly mixed during the week ended May 17, though an early taste of summer-like temperatures helped strengthen markets further south; the NGI Weekly Spot Gas National Avg. added 3.0 cents to $2.210/MMBtu.

NatGas Cash, Futures Retreat Ahead of Triple-Digit Storage Build

After consecutive daily gains going back to last week, U.S. natural gas futures reversed sharply Wednesday as estimates pointed to a larger-than-average build in upcoming weekly storage data. In the spot market, with more intense cooling demand not expected until next week, discounts were widespread across the Lower 48; the NGI Spot Gas National Avg. skidded 9.5 cents to $2.210/MMBtu.