LNG | International | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Oil, Natural Gas Prices Jump as Fears Over Russian Supply Disruptions Grow – LNG Recap

Oil and natural gas prices climbed higher Monday in another volatile stretch of trading as the market weighed the possibility of significant supply disruptions tied to the latest round of sanctions against Russia amid continued fighting in Ukraine.

An initial round of talks to discuss a ceasefire Monday also yielded no results as Russia finds itself increasingly isolated. Economic sanctions have caused the ruble to plummet.

Meanwhile, foreign investors are fleeing Russia after it attacked Ukraine last week. Western majors, including BP plc, Equinor ASA and Shell plc all announced plans Monday to exit stakes in the company despite the possibility of steep impairments. Shell said it was exiting its stakes in the Nord Stream 2 pipeline and the Sakhalin-2 LNG facility, a plant just north of Japan near key demand centers in Asia.

Expanding Sanctions

As pressure grows and sanctions continue to create uncertainty, the market is girding for oil and gas supply disruptions. The European Union also held an emergency meeting Monday to discuss how to respond if Russia, its biggest supplier, cuts off natural gas flows in response to sanctions.

Over the weekend, the United States and its allies barred some Russian banks from using SWIFT, or the Society for Worldwide Interbank Financial Communications system, limiting Russia from exporting certain goods and capturing revenues from international trade. The platform is used to help process transactions. The West also committed to imposing restrictive measures on the Russian Central Bank.

“From the very beginning, both Europe and the United States said there would be a carve out for energy transactions from sanctions,” said Craig Pirrong, a professor of finance at the University of Houston. “It appears that in these very early days a lot of financial institutions are effectively self-sanctioning.”

The conflict is creating greater risk in commodity markets. Banks are second-guessing issuing lines of credit to buy liquefied natural gas (LNG) or oil should those cargoes subsequently be subject to sanctions. Some banks, such as Societe Generale SA and Credit Suisse Group AG, have reportedly stopped financing commodities trading from Russia.

“The actual sanctions may be less important here in the near-term than the fear of future sanctions and banks’ reactions to those and also the buyers of commodities,” Pirrong told NGI. “They don’t want to buy something that they can’t end up using or is seized.”

He added that the hesitancy to buy Russian commodities already appears to be disrupting supplies. Pirrong pointed to the steep discount between Russian crude and other global benchmarks, and noted that news media reports have already emerged about buyers suspending the purchase of Russian LNG given the uncertainties.

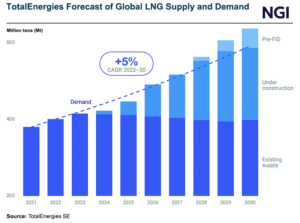

“Russia is one of the world’s top LNG exporters, meaning that global LNG prices could quickly soar as competition escalates for purchases of non-Russian cargoes,” said Schneider Electric analyst Federico Toscano in a Monday note to clients.

Prices Swing

The European natural gas benchmark Title Transfer Facility (TTF) contract for April gained about $2 Monday to finish above $32/MMBtu. Spot LNG prices in Asia also followed European contracts higher, but warmer weather in Asia is expected to keep demand subdued in the coming weeks, freeing up more cargoes for Europe.

In the United States, the prompt Henry Hub lost 6.8 cents to close at $4.402 as mixed weather forecasts and domestic fundamentals outweighed chaos in the global market. Brent crude prices surged Monday, when the April contract gained $3.06 to finish at $100.99/bbl.

Russian pipeline exports to Europe were flat Monday, but European buyers have been purchasing more. Russian volumes to the continent surged Thursday, Friday and over the weekend, which had weighed on prices. Deliveries on the Yamal-Europe pipeline into Germany hit 2 million cubic meters on Friday, the first time gas has flowed westbound into the Mallnow compressor station since December.

The market, however, is clearly on edge about how long the trend could last.

Germany, which purchases more than half its supplies from Russia, said over the weekend it would lean more heavily on other resources and even accelerate development of two LNG import terminals. Uniper SE was also said to be reconsidering an LNG import project it canceled last year near the port of Wilhelmshaven.

“The fact that Germany has signaled a U-turn in key energy policies on Sunday, floating the possibility of extending the lifespans of coal and even nuclear plants to cut dependency on Russian gas, suggests that at some point a decision to halt Russian gas imports can no longer be ruled out,” analysts at Engie EnergyScan said Monday.

Germany is Europe’s top gas consumer, but it has no regasification facilities to receive LNG. The country imports more than 90% of its gas via pipeline to meet demand.

The country had planned to exit coal by 2030 and has been slow to approve the import terminals, demonstrating how much of an impact the conflict in Ukraine is already having on European energy policy. Dutch energy network operator NV Nederlandse Gasunie also said Monday that it would consider adding additional LNG import capacity for the continent.

Vortexa Ltd.’s Felix Booth, head of LNG, told NGI that while the terminals couldn’t entirely replace Russian pipeline gas in the country’s energy mix, they could significantly boost LNG demand on the continent over the next five years.

“This event will support European and Asian gas prices well into summer,” Booth added of the conflict’s broader impact on the global gas market. “Plus the longer-term implications of the Nord Stream 2 approval process being halted, and Russian gas flows to be limited to contract requirements for a prolonged period, has significantly impacted European gas prices out to 2024.”

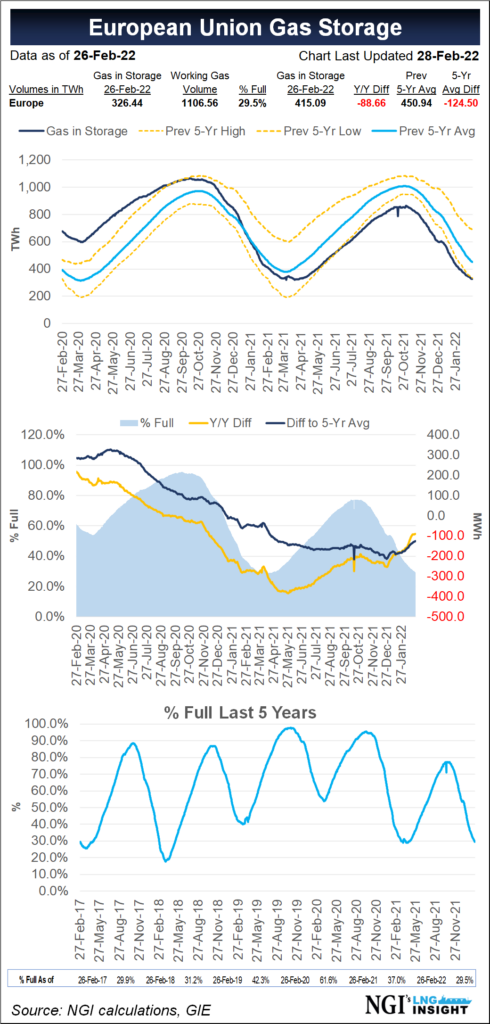

European storage inventories were already low well before Russia invaded Ukraine. They’ll need to be restocked in order to better rebalance the global gas market and tame prices. Prices are up across the curve, particularly next winter.

Anna Mikulska, a nonresident fellow in energy studies at Rice University’s Baker Institute for Public Policy, told NGI Friday that the market will begin shifting its concern to winter 2022-2023 if the conflict continues. Warmer weather is expected soon as spring nears, she said, which is helping keep a lid on prices. Editor’s Note: This segment is regularly available to subscribers of NGI’s LNG Insight. It covers weekly developments in the global natural gas markets and is being made available free due to escalating tensions between Russia and Ukraine. To request a trial to NGI’s LNG Insight click here.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |