Markets | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Crude Producers Hold the Line on Supplies; Russian Aggression Clouds Outlook

U.S. producers kept output flat amid commitments to discipline and rapidly evolving geopolitical tensions that reached new heights Thursday with Russia’s invasion of Ukraine.

Domestic production for the week ended Feb. 19 was flat with the two prior weeks and most of 2022 at 11.6 million b/d, the U.S. Energy Information Administration reported Thursday.

While several prominent U.S. exploration and production companies have during earnings season highlighted increased output in the Permian Basin to meet mounting crude demand, most have also emphasized discipline elsewhere. Lower 48 producers are under pressure from investors to steadily shift capital expenditures away from oil to renewable fuel projects.

At the same time, however, crude consumption is mounting. While choppy from one week to the next, overall demand climbed through 2021 and continues to accelerate this year as economic activity hastens and calls for travel fuels derived from oil climb.

Total petroleum demand last week dipped 5% week/week but consumption over the past month remained elevated, EIA’s latest Weekly Petroleum Status Report showed.

Products supplied over the last four-week period averaged 21.9 million b/d, up 12% from the same period last year. Over the same span, motor gasoline demand averaged 8.6 million b/d, up 11%, while distillate fuel consumption averaged 4.4 million b/d, up 4%. Jet fuel product supplied jumped 40% to nearly 1.5 million b/d.

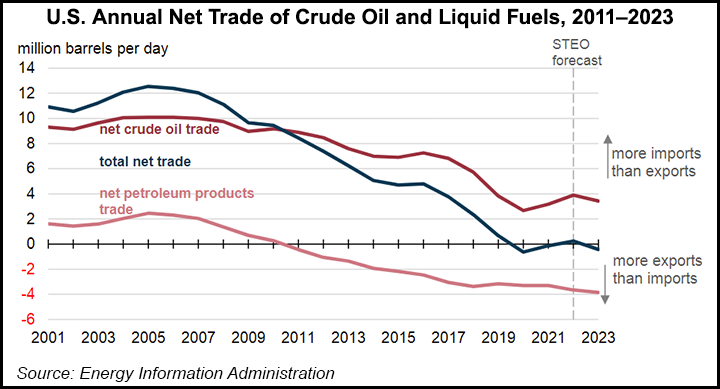

To meet the demand, the United States ramped up imports. U.S. crude imports averaged 6.8 million b/d last week, up by 1.0 million b/d from the previous week, EIA said. Over the past four weeks, imports averaged about 6.5 million b/d, up 14% from the comparable period last year.

U.S. commercial crude inventories last week, excluding those in the Strategic Petroleum Reserve (SPR), increased by 4.5 million bbl from the previous week. Still, at 416.0 million bbl, inventories are about 9% below the five-year average.

Russian Wildcard

White House press secretary Jen Psaki had said during a media briefing Wednesday that the Biden administration could draw from the SPR should Russia’s threats of war against Ukraine escalate. Russia on Thursday followed through with an assault on its eastern European neighbor, with military strikes across Ukraine that sparked fears of oil and gas supply disruption.

The global ramifications of war in Ukraine “may prompt a rethink of the prominence of energy security across the world,” given that Russia is a top producer of both oil and gas, EBW Analytics Group senior analyst Eli Rubin said.

Rystad Energy’s Louise Dickson, senior analyst, agreed. She noted that amid the near-term uncertainty, international Brent crude prices soared above $100/bbl Thursday and could remain elevated.

“War has come to the heartland of Europe, and if the Ukraine conflict draws in the might of the Russian army and other interested and well-equipped forces, unconstrained upside risk to regional geopolitics and oil prices are highly likely,” Dickson said.

This could necessitate supply creativity – including an SPR draw – for the United States to avoid near-term supply problems as other countries that work with Russia may ramp up calls for imports from other suppliers.

“Oil prices are soaring with no end in sight as the news of Russia’s full-scale military incursion of Ukraine” is “immediately putting at risk up to 1 million b/d of Russian crude oil exports transiting through Ukraine and the Black Sea,” Dickson said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |