LNG | International | LNG Insight | Markets | Natural Gas Prices | NGI All News Access

European Natural Gas Turmoil Deepens as Russia Moves Into Ukraine – LNG Recap

Russia’s decision to order military forces into eastern Ukraine, as well as the West’s swift condemnation of the move, on Tuesday weighed on financial markets, added to inflationary pressures and pushed oil and natural gas prices higher, deepening an energy crisis that has gripped Europe since last year.

Natural gas prices in Asia, Europe and the United States ticked upward Tuesday, while Brent crude climbed toward $100/bbl for the first time since 2014.

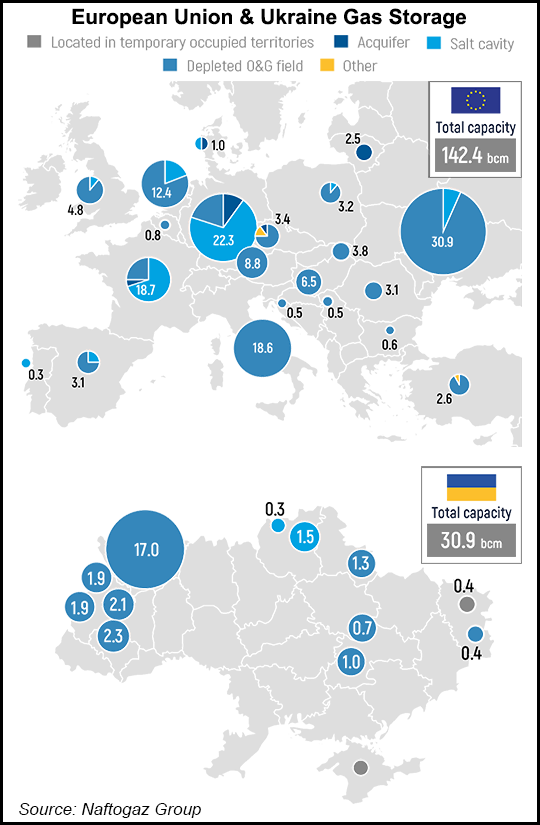

European natural gas stocks were already poised to exit the winter heating season at historical lows, analysts at Barclays said in a note on Tuesday. “Prices are likely to stay high” as a result, they said, adding that “tensions in Ukraine could push them higher.”

Russia provides about one-third of Europe’s natural gas imports. Nearly one-quarter of the 168.7 billion cubic meters Russia sent to Europe last year went through Ukraine, according to the Oxford Institute for Energy Studies.

The European gas benchmark Title Transfer Facility (TTF) gained across the curve Tuesday, with the March contract adding more than $2/MMBtu to finish above $26.

The West had already imposed what leaders said was a first round of sanctions on Russia for its decision to order troops into the breakaway regions of Donetsk and Luhansk. President Biden late Tuesday called the move a “flagrant violation” of international law and said the United States is blocking two large Russian financial institutions and would impose sanctions on Russian debt.

The move in natural gas prices, however, was somewhat muted given the risk of war.

Armed forces moved into areas that are about 100 miles from the lines that move Russia’s natural gas through Ukraine. A major line moving Russian oil to Europe is more than 400 miles away. Russia has also diversified its natural gas transit routes in recent years and can move gas to Europe via Belarus, the Baltic Sea, Poland and Turkey if a broader conflict were to impact pipelines in Ukraine.

“The Russians have an economic dependency on lucrative gas sales to Europe,” said analysts at Evercore ISI led by Sean Morgan. Europe’s depleted storage and heavy reliance on Russian supplies, “mean that short of a complete Ukrainian military conflagration,” the continent’s imports of gas are unlikely to be stopped “due to economic necessity for all parties involved,” Evercore added.

German Chancellor Olaf Scholz said Tuesday his country would suspend certification of the Nord Stream 2 pipeline in response to Russia’s move into Ukraine. The system is complete and waiting for regulatory approval to move more natural gas from Russia to Germany. It is seen as a vital link to alleviate European supply shortages.

Russian President Vladimir Putin said in response to Scholz’s announcement that the country would continue to move pipeline gas and LNG exports to international markets despite growing tensions.

“We would not expect him to say otherwise,” analysts at ClearView Energy Partners LLC wrote in a note to clients Tuesday. “If Russia uses its ‘energy weapon,’ we still think supply curtailment is likely to be cloaked in plausible deniability (e.g., maintenance).”

A week ago, Russia said it was pulling back some troops amassed near the Ukraine border. The seeming de-escalation largely dragged down natural gas prices along with mild weather and increasing LNG arrivals in Europe up until Tuesday.

LNG prices in Asia followed TTF higher. The Japan-Korea Marker spot price was assessed above $26 on Tuesday, narrowing the spread to European markets. Demand in China has picked up following the Lunar New Year, according to Rystad Energy. The firm said colder weather in Japan and South Korea this month is likely to stoke further restocking demand as the spring nears.

Oil also hit an intraday high of $99.50/bbl on Tuesday before closing at $96.84 for April delivery.

“…Any perceived risk to Russian supply has a pronounced impact for prices as Russian crude production typically accounts for around 10% of total global supply – roughly in line with production levels in the United States and Saudi Arabia,” said Schneider Electric’s Robbie Fraser, global research and analytics manager.

U.S. natural gas prices were up as well Tuesday, tracking gains in the TTF contract and getting a lift from shorter-term forecasts calling for colder-than-normal temperatures for some parts of the country. The March Henry Hub contract gained six cents to finish at $4.49.

However, the value proposition for American LNG exports is “already sufficient” to ensure domestic LNG terminals will “run at maximum capacity factors,” said EBW Analytics Group senior analyst Eli Rubin of the wide arbitrage spread between the United States and Europe.

For the U.S. market, this weakens the “fundamental connection to European developments. Nonetheless, algorithmic traders or large macro funds may merely repeat the higher international natural gas technical correlations from last fall,” Rubin added.

The United States was Europe’s largest supplier of LNG last year, accounting for 26% of all the European Union’s cargoes, the Energy Information Administration said Tuesday.

Evercore’s team said Tuesday that a prolonged political or military confrontation between Ukraine and Russia “would support the pull of European demand to increase U.S. LNG exports from brownfield LNG site expansions, and potentially greenfield LNG export start-ups.”

Editor’s Note: This segment is regularly available to subscribers of NGI’s LNG Insight. It covers weekly developments in the global natural gas markets and is being made available free due to escalating tensions between Russia and Ukraine. To request a trial to NGI’s LNG Insight click here.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |