LNG | LNG Insight | Markets | NGI All News Access | NGI Mexico GPI | NGI The Weekly Gas Market Report | Shale Daily

NGI’s Daily LNG Data Available for Free Download for Limited Time

The key daily data that drives both the global natural gas market and NGI’s LNG Insight is now available at no cost for a limited time.

NGI subscribers and website visitors may access a daily Microsoft Excel spreadsheet for download that includes more than 20 sets of data compiled each day. Subscribers of all NGI publications may download the data here, while visitors access is here.

When the complimentary period concludes, LNG Insight subscribers would continue to have access to the spreadsheet as part of ongoing efforts to further develop news and data offerings following the publication’s launch in late 2019.

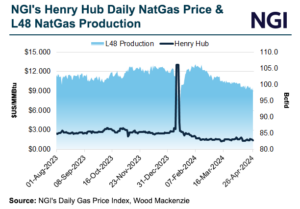

Liquefied natural gas (LNG) exports now account for roughly 15% of U.S. gas demand and can have a “profound impact on domestic natural gas prices,” said NGI’s Patrick Rau, director of strategy and research. “Tracking and trading U.S. pipeline basis differentials is complex enough, but understanding LNG prices requires incorporating several additional layers of global data.”

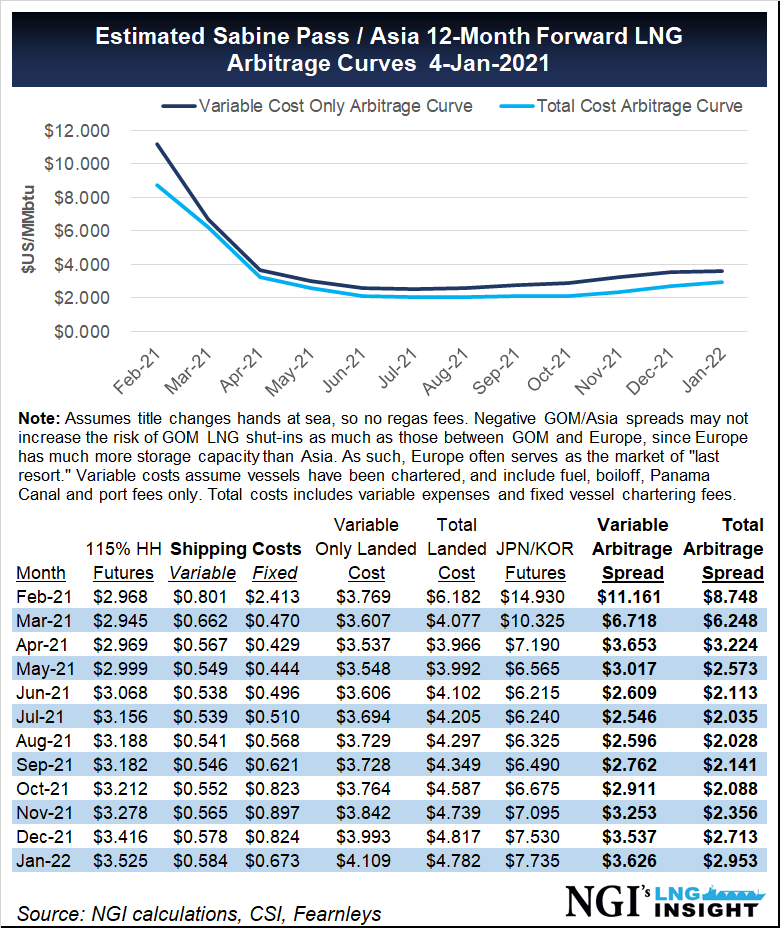

Each day, LNG Insight offers arbitrage spreads between the United States, Asia and Europe to track the profitability of American LNG. The publication also offers Gulf Coast netbacks, vessel rates, global gas futures prices, feed gas deliveries to U.S. terminals and European natural gas storage information, among a wide array of other data that is available for download.

Asian and European gas prices influence demand for U.S. gas as consumption overseas has continued to grow, and comprehending global fundamentals is key. For example, Europe is typically the last resort for global LNG cargoes when the market is oversupplied. When storage there is near capacity, it may cause cargo cancellations, as happened last year.

Shipping costs also may by themselves determine whether U.S. LNG is profitable. Those costs can fluctuate, depending on the supply and demand of LNG vessels.

“The bottom line is that myriad data determine the profitability of U.S. LNG, and those factors are constantly changing,” Rau said. “Keeping tabs of those is important not only for global LNG traders, but also for domestic U.S. pipeline buyers and sellers. NGI’s daily LNG Insight spreadsheet allows market participants to track those data in one concise easy to use format.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 | ISSN © 2158-8023 |