International | E&P | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report | Oil

Shell Ending Involvement in All Russian Hydrocarbons, Ceasing Spot Crude Oil Purchases Immediately

Shell plc is withdrawing its involvement in “all Russian hydrocarbons,” it said Tuesday, including oil, petroleum products, natural gas and liquefied natural gas (LNG).

“As an immediate first step, the company will stop all spot purchases of Russian crude oil” and “shut its service stations, aviation fuels and lubricants operations in Russia.”

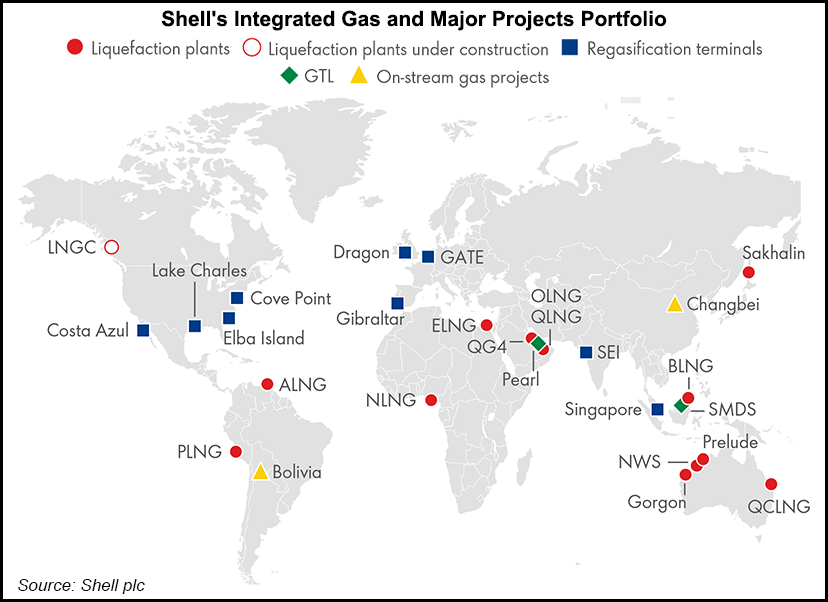

The phased approach follows a decision last week to exit joint ventures with Russia’s Gazprom, the state-controlled energy giant behind the Nord Stream 2 natural gas pipeline and related entities, including its 27.5% stake in the Sakhalin-II LNG facility, its 50% stake in the Salym Petroleum Development and the Gydan energy venture.

The decisions by Shell follow Russia’s unprovoked war with Ukraine, which has drawn nearly worldwide condemnation.

“We are acutely aware that our decision last week to purchase a cargo of Russian crude oil to be refined into products like petrol and diesel – despite being made with security of supplies at the forefront of our thinking – was not the right one and we are sorry,” CEO Ben van Beurden said.

“As we have already said, we will commit profits from the limited, remaining amounts of Russian oil we will process to a dedicated fund. We will work with aid partners and humanitarian agencies over the coming days and weeks to determine where the monies from this fund are best placed to alleviate the terrible consequences that this war is having on the people of Ukraine.”

Shell’s actions to date, said the CEO, “have been guided by continuous discussions with governments about the need to disentangle society from Russian energy flows, while maintaining energy supplies.

[Download Now: In our 2024 Natural Gas Outlook Report ‘Future In Focus’, Natural Gas Intelligence’s experienced team of Thought Leaders delve into the myriad opportunities and questions the industry faces, with a focus on market dynamics, upstream outlooks and price forecast trends that will shape the future global natural gas landscape. Learn more.]

“Threats today to stop pipeline flows to Europe further illustrate the difficult choices and potential consequences we face as we try to do this. Following government statements this week, I want to set out our position clearly.”

Unless Shell is directed by governments, it plans to not only end spot oil market purchases but “not renew term contracts,” he said.

“At the same time, in close consultation with governments, we are changing our crude oil supply chain to remove Russian volumes. We will do this as fast as possible, but the physical location and availability of alternatives mean this could take weeks to complete and will lead to reduced throughput at some of our refineries.”

Withdrawing from Russian oil, natural gas and LNG “is a complex challenge. Changing this part of the energy system will require concerted action by governments, energy suppliers and customers, and a transition to other energy supplies will take much longer,” he noted.

“These societal challenges highlight the dilemma between putting pressure on the Russian government over its atrocities in Ukraine and ensuring stable, secure energy supplies across Europe,” said van Beurden. “But ultimately, it is for governments to decide on the incredibly difficult trade-offs that must be made during the war in Ukraine. We will continue to work with them to help manage the potential impacts on the security of energy supplies, particularly in Europe.”

Shell’s announcement came a day after German utility Uniper SE, one of the largest buyers of European natural gas, said it would not enter into new long-term gas supply contracts with Russia. The company also said it would divest Unipro, which operates power plants in Russia and take an impairment on its loan for the NS2 project.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |