NGI Archives | NGI All News Access

Warren Resources Acquires Anadarko’s Atlantic Rim Assets For $21M

Beefing up its Atlantic Rim Project area acreage in the Washakie Basin of Wyoming, which includes shallower coalbed methane (CBM) targets and the Niobrara Shale below, Warren Resources Inc. is exercising its preferential rights to acquire additional oil, natural gas and midstream assets from subsidiaries of Anadarko Petroleum Corp for approximately $21 million.

Warren CEO Espy Price said the deals increase the company’s ownership in the Atlantic Rim area and give Warren 100% control of the midstream pipeline assets. “The Atlantic Rim acquisition provides us with immediate and significant increases in production and proved reserves at a very competitive price,” Price said. “By hedging natural gas prices through 2014, this acquisition is expected to result in attractive economics even at today’s suppressed gas prices. Additionally, the acquisition increases our large acreage position in the coalbed methane assets and the prospective, deeper formations, including the Niobrara.”

Anadarko had no comment Tuesday on Warren exercising its preferential rights to acquire the assets and acreage.

Warren has agreed to acquire:

In August Warren reported that Anadarko had put its Atlantic Rim assets on the block (see Daily GPI, Aug. 9). At the time Anadarko had no comment about the sale. The producer wrote down $978 million in 2Q2012 in part because of low natural gas prices for CBM (see Daily GPI, Aug. 1).

During the August conference call Price said that while Warren was interested in the Niobrara and Green River formations, it currently had no plans to do any “deep testing.”

Warren said it elected to exercise its preferential rights after Anadarko advised the company of an agreement to sell these assets to a third party. Depending upon the exercise of preferential rights to purchase the oil and gas assets held by other working interest owners in the Spyglass Hill and Catalina units, the amount of working interests to be acquired by Warren and the purchase price to be paid by Warren could be reduced proportionately.

The transactions are expected to close around Sept. 27. Upon the resignation of Anadarko as the current operator, Warren said it anticipates it will become the successor operator of the Spyglass Hill unit and the midstream assets.

Price added that the purchase price of approximately $1,400 per flowing Mcf is well below recent industry transactions. “Given our long-term knowledge of the Atlantic Rim assets, we also believe that, as the successor operator, we may be able to reduce operating costs,” he said.

In anticipation of closing the acquisition, Warren disclosed that it has entered into New York Mercantile Exchange natural gas swaps for 7 MMBtu/d at a price of $3.39/MMBtu for 2013 and $3.78/MMBtu for 2014.

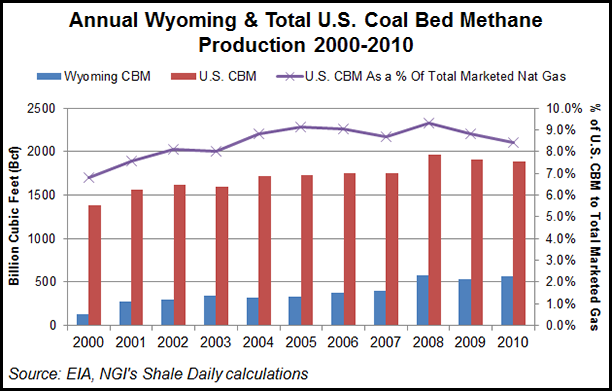

With the arrival of shale gas development and depressed natural gas prices, CBM production as a share of total U.S. gas production in the United States has declined every year since 2008.

According to the Energy Information Administration (EIA) and data compiled by NGI’s Shale Daily, Wyoming saw the most CBM production in 2010 within the United States with 566 Bcf. Colorado and New Mexico were second and third with 533 Bcf and 402 Bcf, respectively. Overall, CBM production accounted for 8.4% of total U.S. marketed natural gas in 2010, but that percentage has fallen each year since reaching a 10-year peak of 9.3% in 2008.

Complete statistics from the EIA are not available for 2011, but CBM most likely contributed even less to the overall U.S. production picture in 2011, given the continued rise in shale and other unconventional drilling, and the general lack of drilling capital that producers dedicated to dry gas areas in recent months. CBM plays are almost 100% methane, and therefore do not receive any economic uplift from natural gas liquids production.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |