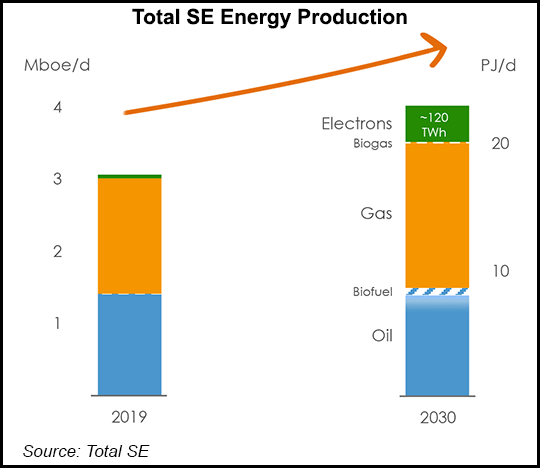

French supermajor Total SE aims to transform itself over the next decade by building its reach in the “two fastest growing energy markets,” liquefied natural gas (LNG) and electricity, the CEO said.

In presenting the Paris-based operator’s long-range strategy on Wednesday, CEO Patrick Pouyanné said the thrust is similar to other European-based majors. The outlook boils down to increasing energy production from LNG and electricity, while decreasing carbon emissions.

The goal is to become a net zero carbon emitter by 2050.

“Growing energy demand and getting to net zero are the two global trends underpinning the Total energy outlook and thus the evolutions of the energy markets that Total integrates into its strategy,” Pouyanné said.

“Our strategy derives from...