Energy Transfer LP has sold about 25% of capacity for its proposed 1.5-2.0 Bcf/d Warrior Pipeline, which it expects the market will need to meet natural gas transportation needs along the Gulf Coast within the next few years, executives said. During a fourth quarter earnings call, Co-CEO Marshall McCrea said the Dallas-based midstream giant had…

Topic / Permian Basin

SubscribePermian Basin

Articles from Permian Basin

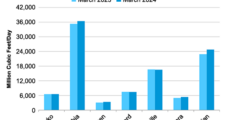

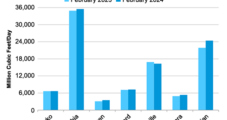

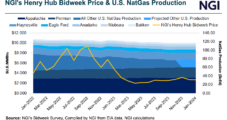

Declines from Natural Gas Plays, Permian Gains to Hold Production Flat in March, EIA Says

Growth in the Permian Basin, countered by declines in Appalachia and the Haynesville Shale, will see combined natural gas production from key Lower 48 regions hold steady at just over 100 Bcf/d in March, according to the U.S. Energy Information Administration (EIA). Total production from seven major Lower 48 producing regions — a list that…

Permian Heavyweights Diamondback, Endeavor Joining Forces in $26B Merger

Diamondback Energy Inc. is merging with privately held Endeavor Energy Resources LP to create a Permian Basin juggernaut in a $26 billion cash and stock transaction, the companies said Monday. Upon joining forces, the two Midland, TX-based independents would boast about 830,000 net acres and 816,000 boe/d of combined net production. The merger, expected to…

MPLX Exploring Organic Growth Opportunities in Permian, Marcellus and Utica

MPLX LP management said its 2024 growth outlook is anchored in the Permian Basin and Marcellus Shale, which provide steady sources of opportunities, particularly around natural gas and natural gas liquids (NGL) assets. It also sees potential in the Utica Shale. “We plan to continue growing these operations through organic projects, investment in our Permian…

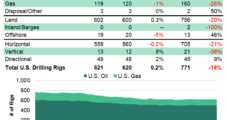

Natural Gas Count Eases Lower as Permian Activity Climbs, BKR Data Show

Total active U.S. natural gas rigs decreased by one to 119 for the week ended Friday (Jan. 26), while an uptick in Permian Basin activity helped lift the combined domestic tally one rig overall to 621, according to the latest count from Baker Hughes Co. (BKR). U.S. oil-directed rigs increased by two for the period…

Permian to Partly Offset Natural Gas Production Declines from Gassy Plays in Early 2024, EIA Says

Shrinking volumes from gassy plays will overshadow higher associated output from the Permian Basin to drive a modest decline in natural gas production from key Lower 48 regions in early 2024, according to the latest modeling from the U.S. Energy Information Administration (EIA). In its updated Drilling Productivity Report (DPR), EIA projected 98.889 Bcf/d of…

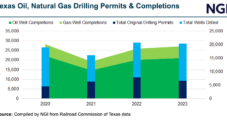

Texas Natural Gas, Oil Drilling Activity Show Mixed Results in December, Down Overall from 2022

Texas regulators issued about 1,500 fewer oil and natural gas drilling permits in 2023 than in 2022, with December permitting continuing the downward trend across most of the state. The Railroad Commission of Texas (RRC) issued a total of 669 drilling permits last month, up by about 30 from November’s count, but down by 200…

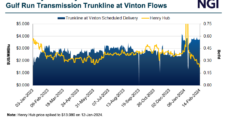

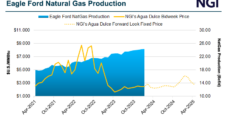

LNG, Mexico Exports Driving South Texas Natural Gas Demand Growth

LNG and Mexico exports are expected to underpin U.S. natural gas demand growth over the coming years, with the Agua Dulce hub in South Texas playing a critical supply role. In turn, both markets are building out infrastructure to ensure access to molecules and capacity in an increasingly competitive and globalized gas market. “Feed gas…

Chatter Grows about E&P Pullback as Mild Early Winter Weather, Robust Natural Gas Storage Pressure Prices

A growing number of analysts have penciled in lower natural gas prices and more gas and oil production cuts for 2024 to remedy supply-demand imbalance, which worsened late in 2023 amid a mild start to winter and record production levels. The heating season only saw intermittent cold spells in November before December clocked in as…

APA Joining E&P Merger Parade with Takeover of Permian-Focused Callon

Houston’s APA Corp., which in recent years has pursued overseas oil and gas prospects, is storming back to the Permian Basin with a $4.5 billion all-stock takeover of Callon Petroleum Co. APA, long a Permian exploration and production (E&P) stalwart, already has a broad portfolio in the Midland and Delaware formations. In the Delaware, where…