Unconventional oil and gas activities and production continued to make their significance felt in mergers and acquisitions (M&A) in the oil and gas sector last year, with much of the new domestic investment coming from foreign companies, according to Deloitte.

Tag / Valuations

SubscribeValuations

Articles from Valuations

Utica Shale Emerging as Possible Triple Threat, Says IHS

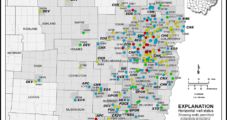

It’s too early in the game to know if the productivity power of the Utica/Point Pleasant Shale in Ohio and western Pennsylvania will match other U.S. unconventional plays, but initial natural gas well data is encouraging, and if the oil-prone window is successfully derisked, the play could prove to be a triple-play hydrocarbon monster, according to IHS Inc. researchers.

Flaring Easing as North Dakota E&P Issue

With rig counts, prices and liquids all moving up, the incidence of natural gas flaring in the Bakken Shale play is expected to continue to decline throughout this year, the head of the North Dakota Petroleum Council, Ron Ness, told NGI’s Shale Daily Wednesday, responding to questions about a report on the state’s record-setting oil/gas operations from the state Department of Mineral Resources (DMR).

Calpine May Sell Up to Eight Power Plants; Targets $3B-Plus Debt Reduction

Calpine Corp. is evaluating the sale of up to eight power plants to capture stronger market valuations under a broader strategic initiative rolled out last Wednesday aimed at dramatically enhancing the company’s financial strength.

CSFB Analysts Tell Investors Not to Fear Merchant Energy Business

Analysts at Credit Suisse First Boston are looking for a return to positive valuations on merchant energy company stocks because of the current pricing environment and customer demand for risk management and energy services. CSFB analyst Philip Sales said Oneok (OKE) in particular should maintain consistent earnings from merchant energy operations.

CSFB Analysts Tell Investors Not to Fear Merchant Energy Business

Analysts at Credit Suisse First Boston are looking for a return to positive valuations on merchant energy company stocks because of the current pricing environment and customer demand for risk management and energy services. CSFB analyst Philip Sales said Oneok (OKE) in particular should maintain consistent earnings from merchant energy operations.

Entergy Still Shopping for Assets, But Waiting on Better Valuations

Entergy Corp. remains on the prowl for energy-related assets to buy, a top official with the utility said last week, but it remains frustrated with the asking price for those assets. Echoing comments recently made by another utility executive, Entergy CEO Wayne Leonard said that the recent wave of generator bankruptcies may result in more realistic prices for such things as power plants.