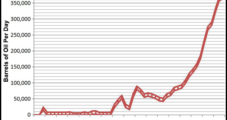

The railroad transportation of Bakken oil supplies continues to grow, and transporters are investing in new facilities on a pace with pipeline takeaway growth, according to the latest statistics from the North Dakota Department of Mineral Resources (DMR) and the state pipeline authority.

Unload

Articles from Unload

Northeast Points Lead Trek Lower; $3.10 Futures In Sight

Overall cash market weakness of about a nickel was led by Northeast marketers anxious to unload what may have been some overzealous purchases for July. Points on Transwestern were also lower as a compressor station was expected to return to service. At the close of futures trading August was unchanged at $2.824 after opening about a nickel lower and September softened .01 cent to $2.832. August crude oil fell $1.21 to $83.75/bbl.

Canadian Superior Unloads Offshore Trinidad Interest

In a measure taken to help it move out of insolvency, Canadian Superior Energy Inc. said last week it has agreed to unload a 45% interest in gas development Block 5(c), located off the southeast coast of Trinidad, to Centrica plc for US$142.5 million in cash. Centrica said the gas — processed into liquefied natural gas (LNG) — could supply its customers in the UK, with additional optionality provided by Centrica’s North American customer base and the opportunity to sell into other Atlantic Basin markets.

Centrica Acquires Canadian Superior’s Interest Offshore Trinidad

In a measure taken to help it move out of insolvency, Canadian Superior Energy Inc. said Tuesday it has agreed to unload a 45% interest in gas development Block 5(c), located off the southeast coast of Trinidad, to Centrica plc for US$142.5 million in cash. Centrica said the gas — processed into liquefied natural gas (LNG) — could supply its customers in the UK, with additional optionality provided by Centrica’s North American customer base and the opportunity to sell into other Atlantic Basin markets.

Soft Prices, Abundant Supply Prompt Cutbacks at Chesapeake

Oklahoma City-based Chesapeake Energy Corp. has looked at the markets for gas, producing properties and gas infrastructure and determined it’s a good time to unload some assets and scale back drilling and production plans, particularly in light of abundant supply and low prices.

Chesapeake Monetizing Assets, Cutting Production, Drilling

Oklahoma City-based Chesapeake Energy Corp. has looked at the markets for gas, producing properties and gas infrastructure and determined it’s a good time to unload some assets and scale back drilling and production plans.

NGI The Weekly Gas Market Report

Anadarko Canada Sale Expected to Fetch $4.5B

With buyers said to be lined up with unsolicited offers, Anadarko Petroleum Corp. announced last week it will unload profitable subsidiary Anadarko Canada Corp. for an undisclosed price. In 2005, the Canadian subsidiary provided 11% of Anadarko’s total proved reserves. Analysts expect the unit to fetch more than $4 billion.

Sempra Sells Energy Production Unit in $225M Deal

Continuing to unload noncore assets for solid profits in preparation for its liquefied natural gas (LNG), gas storage and pipeline projects coming to fruition in the next three years, Sempra Energy announced Monday it has agreed to sell its exploration and production subsidiary, Sempra Energy Production Co. (SEPCO) to PEC Minerals LP for approximately $225 million in cash. Sempra said it expects to close the deal next momth.

Industry Brief

Petrohawk Energy Corp. closed its previously announced North Louisiana gas properties acquisition and entered into a separate transaction to unload its Gulf of Mexico properties. First announced in December (see Daily GPI, Dec. 15, 2005), the Houston-based junior independent purchased two packages of natural gas reserves in the Elm Grove and Caspiana fields of northern Louisiana in private transactions for $262 million, before working capital and other closing adjustments. As of Dec. 31, 2005, Petrohawk owned 551 Bcfe in proved reserves, of which 76% were natural gas. With the added production from this transaction, Petrohawk’s current estimated production rate is 146 MMcfe/d. The acquired reserves are 98% natural gas and include an estimated 106 Bcfe of proved reserves and 100 Bcfe of probable and possible reserves. The assets include about 27,400 gross acres, with 80% of them operated. They include 11 producing wells and 185 identified drilling locations. Average 2006 projected output is expected to be 20 MMcfe/d; current production is 16 MMcfe/d. Lease operating expenses for 2006 are estimated to be $0.55/MMcfe. Petrohawk also announced Monday it is has entered into a definitive agreement with a private company to sell substantially all of its Gulf of Mexico properties for $52.5 million in cash. Petrohawk said these properties have internally estimated proved reserves of 26 Bcfe, are 70% gas, and are 59% proved developed and 27% operated, with lease operating expenses of $2.35 per Mcfe. Petrohawk estimates current production at 10 MMcfe/d. The transaction is expected to close in March 2006.

Shell to Unload Massive Gulf of Mexico Gas Pipe Business

Houston-based Shell US Gas & Power LLC announced Friday it has put its Gulf of Mexico natural gas pipeline business unit, Shell Gas Transmission LLC, on the sale block. The unit owns or has an interest in 17 major offshore gas pipes in operation or under construction, with total capacity of about 9 Bcf/d.