July natural gas is expected to open a penny lower Wednesday morning at $4.52 as traders see the bullish case losing momentum and technical signals deteriorate. Overnight oil markets firmed.

Trend

Articles from Trend

Pioneer Gets A ‘Strong Mabee’ on Wolfcamp B Prospectivity

Pioneer Natural Resources Co.’s first horizontal Wolfcamp Shale well in Martin County, TX, — the Mabee K #1H — has been placed on production with an initial rate that the company called “strong,” and an analyst following Pioneer said confirms prospectivity in the county.

AEP’s Fuel Switching Leans Toward Coal

Bucking the recent fuel switching trend, American Electric Power (AEP) in the first three months of 2013 became more dependent on coal and used significantly less natural gas to generate electricity, said CFO Brian Tierney.

Another Deepwater Strike in Gulf of Mexico

Another deepwater well in the Gulf of Mexico (GOM) appears to be a success after the Phobos-1 prospect in the Lower Tertiary Trend encountered 250 feet net of “high-quality oil pay,” said Anadarko Petroleum Corp.

Let’s Make a (Shale) Deal! U.S. Onshore Still Opening Doors, Says PwC

Strategic investors and foreign buyers continue to press for deals in U.S. unconventional fields, but higher prices have pushed private equity (PE) momentarily to the sidelines, according to PwC US.

Chevron Touts St. Malo Test in Deepwater GOM

Chevron Corp. has conducted a successful production test on the St. Malo PS003 well in the prolific Lower Tertiary Trend in the deepwater Gulf of Mexico (GOM), with low rates, though limited by testing equipment constraints, exceeding 13,000 b/d of oil, the operator said Thursday.

Correction

In the first paragraph of a story published Feb. 26, “EIA: Gas Production Increase Continued Through November” (see Daily GPI, Feb. 26), the trend of natural gas production in the United States last year was incorrectly stated. The first paragraph should read: Production continued its steady increase through November, totaling 27.22 Tcf for the first 11 months of 2012, compared with 25.94 Tcf during the same period in 2011 and 24.42 Tcf in 2010, according to the U.S. Energy Information Administration’s Monthly Energy Review for February. NGI regrets the error.

Patterson-UTI’s Surprisingly Strong Results Upend Forecasts

Patterson-UTI Energy Inc. did something in the final three months of 2012 that no other onshore oilfield services provider has announced yet: hydraulic fracturing (fracking) services climbed and sales surpassed expectations — surprising even company executives.

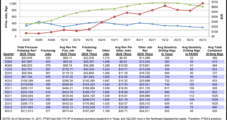

Shale Basins Demonstrate Maxim: Reduced Drilling Begets Higher Prices

Natural gas prices in the various North American shale basins rose about 50 cents, or close to 20%, year-to-year from Jan. 1, 2012 to Jan. 1, 2013, moving mainly from the $2.80s to the $3.30s per MMBtu. At the same time, operating rigs in the same basins dropped 21%, according to surveys conducted throughout the year for NGI’s Shale Daily.

S&P: Marcellus Shale Output Rewriting Gas Flows, Pricing

Rapid development of the Marcellus Shale is attracting new exploration and production (E&P) activity, a trend that is affecting long-standing national and regional natural gas flows, as well as regional pricing, according to Standard & Poor’s Ratings Services (S&P).