Natural gas infrastructure “presents significant opportunities” in the long-term, but not so much today, TransCanada Corp. CEO Russ Girling said last week.

Today

Articles from Today

TransCanada CEO: ‘Continued Weakness’ in Natural Gas Pipelines

Natural gas infrastructure “presents significant opportunities” in the long-term, but not so much today, TransCanada Corp. CEO Russ Girling said Tuesday.

Texas Was an Oil Barn Burner Again Last year

Texas producers boosted crude oil production for the third straight year in 2012, lifting statewide output by nearly 100 million bbl to 604 million bbl, according to the year-end report issued by the economist who compiles the monthly Texas Petro Index.

Carrizo Targets Eagle Ford This Year

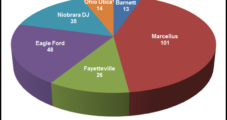

Carrizo Oil & Gas Inc. this year plans to spend $500 million on drilling and completions, with the lion’s share going to the Eagle Ford Shale in South Texas. The Houston-based company said last week it would spend $385 million in the play, $70 million in the Marcellus Shale, $35 million in the Niobrara formation and $10 million for other drilling activity.

Eagle Ford Getting 77% of Carrizo 2013 Drilling Budget

Carrizo Oil & Gas Inc. plans to spend $500 million on drilling and completions this year, with the lion’s share going to the Eagle Ford Shale in South Texas.

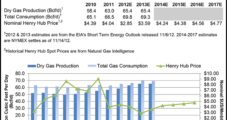

Chief CEO: Shale Gas Long-Term Proposition

Development of the nation’s shale natural gas plays may be a thankless job for producers today, but its value will pay off in the years to come, according to the CEO of Chief Oil & Gas LLC, who hopes to expand his company’s presence in the Marcellus and Utica shales.

Shale Gas Development to Pay Down the Line, says Chief CEO

Development of the nation’s shale natural gas plays may be a thankless job for producers today, but its value will pay off in the years to come, according to the CEO of Chief Oil & Gas LLC, who hopes to expand his company’s presence in the Marcellus and Utica shales.

S&P: Margins to Weaken for Fracking, Pressure Pumping Services

Drilling technologies have transformed the competitive landscape within the oil and gas industry and altered the traditional pricing relationship between crude oil and natural gas, but there’s still plenty of room for horizontal drilling and hydraulic fracturing (fracking) services to grow, according to Standard & Poor’s Ratings Services (S&P).

Western Australia Mandating Well Chemicals Disclosure

The government of Western Australia said Wednesday it will introduce regulations to mandate public disclosure of “any chemicals introduced into a well or formation” although tight and shale gas development in the region is seen as “a number of years away.”

Most Onshore Oil Plays Economic at $65 WTI, Says Raymond James

The Permian Basin, as well as the Eagle Ford and Bakken shales, which today are considered the “big three” drivers of U.S. oil production, would remain economic at current costs if West Texas Intermediate (WTI) crude oil prices were to fall to $65/bbl, according to an analysis by Raymond James & Associates Inc. In fact, 13 of 20 onshore oil plays evaluated would breakeven below $65 using current costs, said analysts.