The U.S. natural gas market — and thus, long-term gas prices — won’t be upended because of the unconventional resource “revolution” because marginal costs ultimately determine gas prices, according to Morningstar.

Thus

Articles from Thus

Colorado Poised to Make Drilling Rules Mandatory

After relying on industry voluntary actions regarding drilling setback and water sampling approaches, Colorado regulators are poised to establish new mandatory rules covering exploration and production (E&P) companies.

Some Range Marcellus Liquids Bound for Europe

Marcellus Shale ethane is a long way from the Mont Belvieu, TX, market center, making it the most likely supply to be rejected in times of surplus. But Marcellus producer Range Resources Corp. has an alternative — and a contract — to deliver some of its ethane to Philadelphia for sale to a European petrochemical producer.

Texas Supreme Court Remands Eminent Domain Case

The Texas Supreme Court has for a second time reversed a court of appeals judgement in a case involving a pipeline company’s use of eminent domain for a public use project and has remanded the case to a district court “for further proceedings consistent with this opinion.”

Louisiana: Drillers Going Where the Taxes Aren’t

Producers active in Louisiana — where they enjoy an exemption from state severance taxes on production from horizontal wells — are increasingly eschewing conventional drilling to take advantage of the tax break, and that’s showing up in state revenue figures, according to a recent forecast from the state’s Legislative Fiscal Office. However, industry advocates advise: look at all the other taxes producers are paying.

ConocoPhillips Exec: Gas Oversupply Situation Overstated

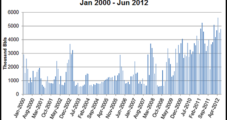

Although a shale-produced natural gas surplus remains, it is at a lower level than many expected and thus a couple of drivers could send prices back into a period of volatility, according to Jim Duncan, chief analyst and commodity market strategist for ConocoPhillips in Houston.

Beware! Gas Price Volatility May Return, ConocoPhillips Exec Says

Although a shale-produced natural gas surplus remains, it is at a lower level than many expected and thus a couple of drivers could send prices back into a period of volatility, according to Jim Duncan, chief analyst and commodity market strategist for ConocoPhillips in Houston.

Oil, Gas Stocks Continue Slide as Dow Falls

The pummeling of oil and natural gas producer stocks, which began last week, continued Monday as the Dow Jones Industrial Average plunged 634 points on the first day of trading after Standard & Poor’s (S&P) late Friday downgraded the United States credit rating from “AAA” to “AA+.”

FERC Shies Away From Generic Ruling on Asset Manager Rates

FERC Thursday ruled that primary firm (releasing) shippers and asset manager replacement shippers are not “similarly situated” in every respect, and thus pipelines are not automatically required to provide asset manager replacement shippers with the same discounted or negotiated usage or fuel charges that they give releasing shippers.

FERC Shies Away From Generic Ruling on Asset Manager Rates

FERC Thursday ruled that primary firm (releasing) shippers and asset manager replacement shippers are not “similarly situated” in every respect, and thus pipelines are not automatically required to provide asset manager replacement shippers with the same discounted or negotiated usage or fuel charges that they give releasing shippers.