A trio of offshore technology specialists is allying to develop innovative subsea well intervention systems, specifically for deep/ultra-deepwater basins and high-pressure environments.

Tag / Schlumberger

SubscribeSchlumberger

Articles from Schlumberger

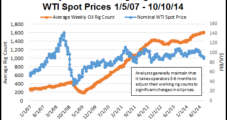

Volatile Commodity Prices May Impact 2015 Onshore Spending Growth, Says Schlumberger CEO

Whether domestic exploration and production companies will slow 2015 capital expenditures if cash flows slow on low commodity prices is too early to say, but any concerns by operators likely will impact spending growth rates, Schlumberger Ltd. CEO Paal Kibsgaard said Friday.

Improving Software A Game Changer for Producers, Says Schlumberger

For Schlumberger Ltd., it’s no longer about what it can do in the oilfield, it’s what it wants to do, a feat increasingly accomplished through high-tech software.

Pressure Pumpers Face Antitrust Lawsuit on Alleged Price Manipulation

The three biggest pressure pumping providers serving U.S. operators — Halliburton Co., Schlumberger Ltd. and Baker Hughes Inc. — are facing a class action antitrust lawsuit over alleged price manipulation, which comes two weeks after the U.S. Department of Justice (DOJ) launched an investigation.

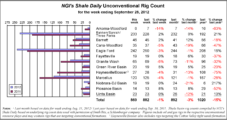

Oil-Gas Lines Blurred As Unconventional Rig Count Declines

Unconventional oil and gas drilling within the 13 plays tracked by NGI’s Shale Daily Unconventional Rig Count dropped by a combined 13 rigs, or 1%, from the previous week to 869 rigs for the week ending Sept. 28. While some of the plays reporting increases or declines in activity were to be expected, others came as a bit of a surprise.

Oil Plays Lead Unconventional Drilling Growth

The Cana-Woodford, Eagle Ford and Bakken/Sanish/Three Forks plays continued to lead the activity growth in unconventional fields over the last year as oil and gas producers put more weight on liquids-rich shales to take advantage of higher commodity prices found in oil and natural gas liquids. Conversely, some of the nation’s dry gas shales have seen the largest drilling activity declines as natural gas prices remain below $4/MMBtu for much of the country.

Prices Meander Despite Unconventional Rig Count Drop

The number of rigs targeting oil and natural gas in U.S. tight sands and shale plays saw a significant drop during the week ending May 20, while oil and gas prices hovered in their recent comfort zones, according to NGI’s Shale Daily Unconventional Rig Count.

Unconventional Drilling Continues Decline

Continuing the downward momentum from the previous week (see Shale Daily, April 11), the number of rigs drilling for oil and gas in U.S. unconventional plays dropped by another 1% for the week ending April 15, according to NGI’s Shale Daily Unconventional Rig Count.

Schlumberger Chief Forecasts Higher Gas Demand Growth

The “fundamentals” for oil and gas remain unchanged, but new opportunities have arisen because of “technology or changed circumstances,” Schlumberger Ltd. CEO Andrew Gould said Monday.

Year-to-Year Shale Basin Rig Counts Show Winners and Losers

What a difference a year makes in shale gas drilling. NGI’s Shale Daily Unconventional Rig Count dramatically demonstrates the ascendance of oil and oily gas shale plays as the Bakken Shale/Sanish/Three Forks claimed the top spot on the chart for the greatest number of active rigs with 170, up from 102 and third place a year ago.