NGI Archives | NGI All News Access

Oil-Gas Lines Blurred As Unconventional Rig Count Declines

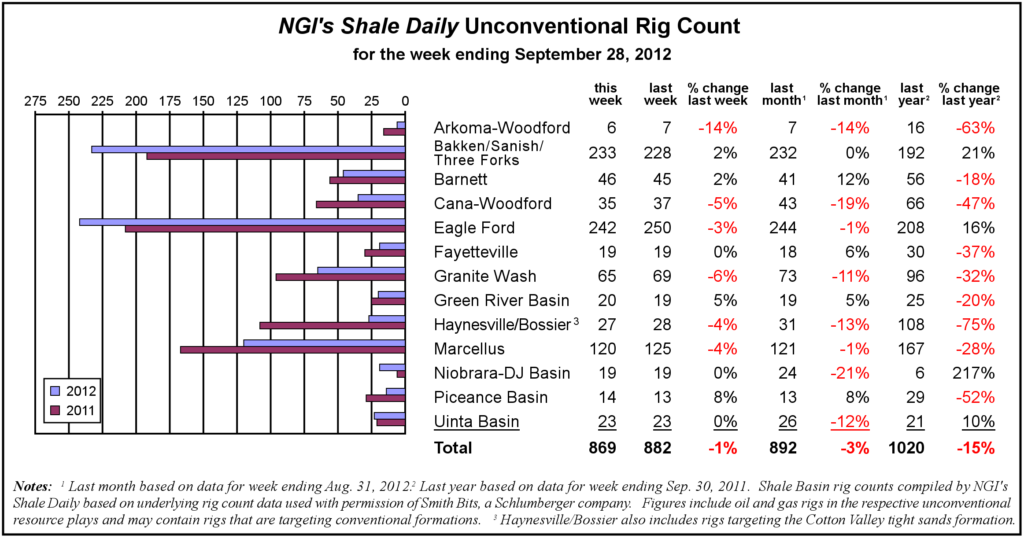

Unconventional oil and gas drilling within the 13 plays tracked by NGI‘s Shale Daily Unconventional Rig Count dropped by a combined 13 rigs, or 1%, from the previous week to 869 rigs for the week ending Sept. 28. While some of the plays reporting increases or declines in activity were to be expected, others came as a bit of a surprise.

With crude oil economics still much more viable than those of dry gas, the liquids-rich Bakken/Sanish/Three Forks region of western North Dakota and northeast Montana saw a 2% jump to 233 rigs from 228 rigs the previous week. However, the similarly liquids-heavy Eagle Ford Shale of South Texas declined by a whopping eight rigs, or 3%, to 242 active rigs for the week ending Sept. 28.

On a year-on-year basis, the liquids-rich unconventional targets are the only plays enjoying more drilling activity today. The Bakken/Sanish/Three Forks region is up 41 rigs, or 21% more than the same week one year ago, while the Eagle Ford Shale is up 34 rigs, or 16% more, and the Uinta Basin of Utah is up two rigs, or 10% more than the same week one year ago.

Just coming into its own, the Niobrara Denver-Julesburg Basin, located in northeast Colorado and southeast Wyoming, saw a 217% increase year-over-year from six rigs to 19 rigs.

Also raising some eyebrows in the week-on-week comparison was the action in the dry-gas Barnett Shale of North Texas, which increased 2%, or one rig, to 46 rigs for the week. There has been growing output by some producers from the Barnett “combo” play, which has high liquids content. Year-over-year, the Barnett is currently 10 rigs, or 18% below last year.

Of the major unconventional plays that reported declines from week to week, the Marcellus Shale of Pennsylvania, West Virginia and Ohio dropped five rigs, or 4% to 120 rigs, which is down 47 rigs, or 28% from one year ago. The Cana-Woodford in Central Oklahoma was down two rigs, or 5% to 35 rigs, which is down 31 rigs, or 47% from one year ago, and the Granite Wash of western Oklahoma and the Texas Panhandle was down four rigs, or 6% to 65 rigs, which is also down 31 rigs, or 32% from a year ago.

Overall for the week, seven of the 13 plays reported no change or an increase in activity over the previous week. However, comparing the week ending Friday, Sept. 28 to the similar week in 2011 tells a different tale.

The current 869 active drilling rig count represents a 15% drop from the 1,020 rigs one year ago. In addition, nine of the 13 plays tracked currently have less drilling activity than one year ago.

NGI‘s Shale Daily Unconventional Rig Count utilizes county-level rig data provided by Smith Bits, a Schlumberger company, to more accurately target drilling levels in individual shale plays (see shaledaily.com).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |