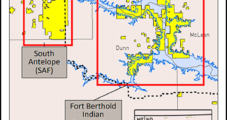

QEP Resources Inc. has secured a deal to sell its Montana and North Dakota assets in the Williston Basin to Vantage Energy Acquisition Corp.

sale

Articles from sale

Dominion Selling Three Power Plants, Considering Blue Racer Sale

Dominion Energy said it has sold its interest in two combined-cycle gas turbine (CCGT) facilities and a hydroelectric project in two separate transactions to an affiliate of Starwood Capital Group Global LP for $1.32 billion.

SandRidge Rejects Offers, Chooses to Develop Assets Instead

SandRidge Energy Inc. said it plans to continue developing its assets in Colorado, the Mississippian Lime and the Midcontinent after the board determined that multiple offers for a merger or a sale fell short of expectations.

Utica Pioneer Chesapeake Takes a Bow, Exits in $2B Sale

Chesapeake Energy Corp. is exiting Ohio’s Utica Shale, a play it pioneered, in a $2 billion divestiture to Houston-based startup Encino Acquisition Partners (EAP), which has plans to aggressively develop the 900,000 net acres.

Gastar Considering Sale, Restructuring

Houston-based Gastar Exploration Inc. said in a regulatory filing on Monday it has hired advisers to explore strategic alternatives, including the possibility of selling the company or restructuring the balance sheet.

Enbridge Selling BC, Alberta Natural Gas Midstream Operations for $3.3B

Production gathering pipelines and processing plants in Canadian natural gas hot spots changed hands Wednesday, when Enbridge Inc. sold field operations in northern British Columbia (BC) and Alberta for C$4.3 billion ($3.3 billion).

EQT Selling Diversified Gas Legacy Huron Assets for $575M

EQT Corp. said Friday that it would sell its formidable 2.5 million net acre position in the Huron formation in Kentucky, Virginia and southern West Virginia for $575 million, parting with an early asset that helped give rise to the nation’s largest natural gas producer before it transitioned to more complex and prolific unconventional operations in the Appalachian Basin.

Briefs — Pioneer Natural

Dallas-based Pioneer Natural Resources Co. has agreed to sell all of its Raton Basin assets in southeastern Colorado, including natural gas wells and infrastructure, to Evergreen Natural Resources LLC for $79 million. Net production from the assets averaged 84 MMcf/d (14,000 boe/d) in 1Q2018, almost all natural gas. The transaction is expected to close by the end of July. The sale is expected to result in a pre-tax noncash loss of $65-75 million in 2Q2018.

SandRidge Says All Offers on Table, Including Any by Icahn

Onshore producer SandRidge Energy Inc., buffeted by bankruptcy, squelched expansion plans and unsolicited takeovers, said Monday it now welcomes input on which direction to take, including any by the largest shareholder, Carl Icahn.

Brief — Brazos Midstream Sale

Brazos Midstream Holdings LLC and financial sponsor Old Ironsides Energy have agreed to sell subsidiaries working on developing the Permian Delaware sub-basin to North Haven Infrastructure Partners II (NHIP II) for about $1.75 billion. Closing is expected by the end of June. NHIP II is an investment fund managed by Morgan Stanley Infrastructure. After closing, Brazos would retain its name and management team, and it would operate as a portfolio company of NHIP II. Brazos is expanding cryogenic natural gas processing in West Texas, among other things. Jefferies LLC is financial adviser to Brazos, while RBC Capital Markets is financial adviser to Morgan Stanley Infrastructure.