Energy Transfer Partners LP’s (ETP) plans to sell a 32.44% stake in its Rover Pipeline to private equity for $1.57 billion met with generally positive reactions from investors Tuesday, but the project still faces uncertainty amid scrutiny from regulators and from Congress.

sale

Articles from sale

BOEM Awards 153 Tracts, Rejects 10 Bids from GOM Lease Sale in March

The Interior Department’s Bureau of Ocean Energy Management (BOEM) this week awarded 153 tracts to companies that bid in March to explore for oil and natural gas in the Gulf of Mexico (GOM), but 10 high bids were rejected.

Sanchez Selling One Eagle Ford Package to Fund Western Part of Play

Sanchez Energy Corp. has sold one piece of its Eagle Ford Shale portfolio to concentrate more funding in the western part of the formation, the Houston-based independent said Friday.

Denbury Paying $71.5M For Linn’s Wyoming CO2 Assets

One week after selling one set of assets, Linn Energy Inc. racked up a second sale, this time agreeing to shed its interest in Wyoming’s Salt Creek Field to Denbury Resources Inc., a carbon dioxide (CO2) enhanced oil recovery (EOR) specialist, for $71.5 million.

Linn Taking $263M for San Joaquin Oil, Gas Assets

Linn Energy Inc. has agreed to sell a portion of its assets in California’s San Joaquin Basin to an undisclosed buyer for $263 million as it continues to reduce its debt.

Alaska’s Cook Inlet Set For First Oil, Natural Gas Auction Since 2008

Oil and natural gas producers will have their first opportunity in nine years to bid for blocks offshore Alaska’s southcentral coast, federal officials said Thursday.

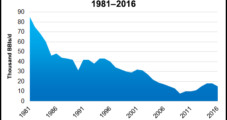

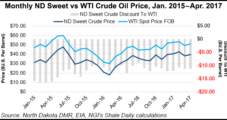

After Disappointing Bids, SM Energy Postpones Sale of North Dakota Assets

SM Energy Co. said it has indefinitely postponed plans to sell its assets in Divide County, ND, after receiving bids that were lower than the company’s expectations.

Brief — BLM Lease Sale

The U.S. Bureau of Land Management (BLM) has clawed back about 43 square miles of public land in western Colorado from a planned June 8 oil and gas lease sale. Tracts in Grand County near Rocky Mountain National Park were dropped, with the sale now covering 115 square miles in parts of Jackson, Routt, Rio Blanco and Moffat counties. BLM Colorado officials said lawsuits had been filed against the sale by Grand County commissioners, a ranch, the Wilderness Society and others. The sale includes acreage in some of the state’s highest potential for oil and gas development, according to the Western Slope Chapter of the Colorado Oil and Gas Association (WSCOGA). WSCOGA Executive Director David Ludlam said he hoped BLM “reduces the practice of deferring lease nominations for political reasons and instead leases new lands for exploration, knowing that environmental review and appropriate mitigation can and will be applied.” Political deferrals “dissuade investment” in future exploration on federal lands, he said.

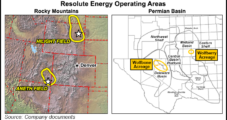

Resolute Pursuing Permian, Breaking Up with Aneth Field

A relentless chase to capture and develop more land in the Permian Basin has led Resolute Energy Corp. to rethink keeping its legacy Aneth Field holdings in Utah’s Paradox Basin.

Brief — SM Energy

SM Energy Co. is selling its Divide County, ND, assets in the Williston Basin. Assuming an acceptable offer is received, the Denver-based producer expects to close a deal around the middle of the year. December production from the assets was 10,700 boe/d. “This sale process continues our drive to generate differential shareholder value through concentrating our capital spending on top-tier asset development,” said CEO Jay Ottoson. “Over the next few years, we intend to focus on generating significant high-margin production growth from our operated acreage positions” within the Permian Basin’s Midland sub-basin and the Eagle Ford Shale. “We expect that the sale proceeds from this planned exit of the Williston Basin and from the pending sale of our nonoperated Eagle Ford assets will allow us to fully fund our drilling program, while providing us with significant liquidity and the ability to reduce our outstanding debt.” Based on acreage and flowing production, Wells Fargo Securities LLC analysts estimated the property value at around $574 million.