Post Oak Energy Capital and funds managed by Goldman Sachs Asset Management have made a $100 million capital commitment to PetroEdge Energy III LLC, a newly formed oil and gas company based in Houston and focused on the Eagle Ford Shale.

Sachs

Articles from Sachs

Natural Gas Surplus Prompts Goldman to Cut Price Forecast

Dry natural gas production in the United States, boosted by stronger pipeline flows from the Marcellus Shale, led Goldman Sachs analysts last week to revise their forecasts down for prices and lift expectations for end-of-summer storage levels.

Nabors Sees ‘Pronounced’ Shortfall in Pressure Pumping, Top Drives

Oilfield services giant Nabors Industries Ltd. on Tuesday warned that operating results for the second quarter will fall below consensus estimates because of a “pronounced” shortfall in the pressure pumping and top drive completion service lines.

Higher Natgas Output Prompts Goldman to Cut Price Forecast

Dry natural gas production in the United States, boosted by stronger pipeline flows from the Marcellus Shale, led Goldman Sachs analysts on Monday to revise their forecasts down for prices and lift expectations for end-of-summer storage levels.

Goldman Lifts U.S. Natural Gas Price, Rig Forecast

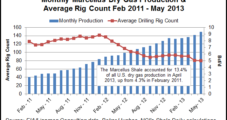

Goldman Sachs on Friday joined two other analyst houses in boosting U.S. natural gas price forecasts, recommending that investors position themselves for “higher prices over the course of 2013.” The gas rig count also is predicted to surpass the 500 mark by the end of the year.

Goldman: Target Upside for 16 Energy Companies

Goldman Sachs analysts recently published their list of the top 40 undervalued stocks and 40% of them were energy-related. Chesapeake Energy Corp. was the only energy stock listed of 25 others “that people expect to fail.”

Goldman Sachs Sees $2.10 Through 2-3Q, Higher in 2013

Analysts at Goldman Sachs said Wednesday they expect natural gas prices will remain low this summer, but recommended buying longer-dated natural gas futures on the presumption that slower production, a declining rig count and a return to normal winter weather would boost prices in 2013.

Talisman Sells Sasol Additional Montney Stake

Calgary-based Talisman Energy Inc. on Tuesday deepened its strategic relationship with Sasol Ltd. by selling it a half-stake in its Cypress A assets in the Montney Shale for C$1.05 billion.

Goldman Cuts Price Forecast Despite Positive View on Economy

Sometimes what goes down keeps going down. That would appear to be true of natural gas prices. Wednesday analysts at Goldman Sachs cut their 2011 New York Mercantile Exchange (Nymex) gas price forecast to $4/MMBtu from $5.25/MMBtu. And just a day earlier Barclays Capital analysts were asking “Who stepped on my forward curve?”

Nexen to Sell North American Gas Marketing Business

Calgary-based Nexen Inc. has agreed to sell its North American downstream natural gas marketing business to Goldman Sachs’ commodity trading subsidiary J. Aron & Co., according to an e-mail Nexen sent to customers earlier this month.