The Group of Seven (G7) nations has pledged to end imports of Russian oil as part of a broader acceleration of Western sanctions intended to debilitate the Kremlin’s ability to finance its invasion of Ukraine. “We commit to phase out our dependency on Russian energy, including by phasing out or banning the import of Russian…

Russia-Ukraine conflict

Articles from Russia-Ukraine conflict

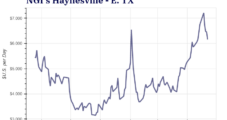

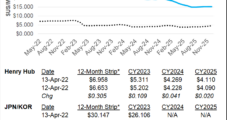

Natural Gas Futures, Cash Prices Flourish as Demand Catalysts Abound, Production Struggles

Natural gas futures soared Tuesday, extending to three days a heated rally and pushing the prompt month above the $8.00/MMBtu threshold in intraday action. Traders assessed warmer weather patterns, the potential for robust summer cooling demand and vulnerable storage levels. The June Nymex gas futures contract ultimately closed at $7.954, ahead 47.9 cents day/day. The…

BP’s Focused on Moving Natural Gas to Europe, with Ongoing Volatile Markets Predicted

BP plc’s primary focus for global natural gas markets today is centered on “flow assurance,” to move enough supply to European countries that remain dependent on Russia, top executives said Tuesday. CEO Bernard Looney was joined by CFO Murray Auchincloss to discuss first quarter performance. The London-based major for several years has been the No.…

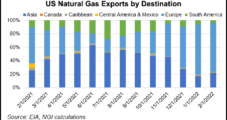

COLUMN: Russia Conflict Creates Market Opportunity for Mexico LNG Export Projects

Editor’s Note: NGI’s Mexico Gas Price Index, a leader tracking Mexico natural gas market reform, is offering the following column by Eduardo Prud’homme as part of a regular series on understanding this process. As part of its effort to displace Russian gas, the Biden administration has committed to sending an additional 15 Bcm of liquefied…

Oil, Natural Gas Lenders Optimistic on 2022 Growth, Cautious Long Term

Banks that actively lend to the oil and natural gas sector are upbeat about strong commodity prices and rising production activity that necessitate new and expanded exploration and drilling projects – and financing to make it happen. Some are reporting loan growth as a result. Others look for increased lending to develop as the year…

Earnings Season to Shed Light on Ability of E&Ps to Profit on High Natural Gas, Oil Prices

Lofty energy prices, driven by steady demand and global supply shocks imposed by Russia’s invasion of Ukraine, present U.S. exploration and production (E&P) companies both profit opportunity and potential hazard. As the first quarter E&P earning season gets in full swing over the coming weeks, markets are expected to focus on whether companies are able…

Dow Touts Advantages of Natural Gas Availability, Joins Germany LNG Project

Management at global petrochemical giant Dow Chemical Co. said Thursday that manufacturing sites with access to shale natural gas resources enjoyed a favorable position during the first quarter of 2022. “Natural gas has been stubbornly high,” said CEO Jim Fitterland during Dow’s earnings call for the first quarter of 2022. “It was higher than last…

For E&P 1Q Results, All Eyes on Ability to Capitalize on Robust Natural Gas, Oil Prices

Lofty energy prices, driven by steady demand and global supply shocks imposed by Russia’s invasion of Ukraine, present U.S. exploration and production (E&P) companies both profit opportunity and potential hazard. As the first quarter E&P earning season gets in full swing over the coming weeks, markets are expected to focus on whether companies are able…

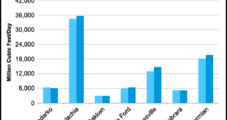

Bulls Extend Run to Four Weeks as U.S. Natural Gas Surges to $7.00 – Mexico Spotlight

North American natural gas futures continued to push higher last week as production and storage worries combined with strong global demand pushed futures prices over $7.00/MMbtu. That’s four straight weeks of rising natural gas prices as energy markets remain in turmoil following Russia’s unprovoked invasion of Ukraine. On Wednesday, the New York Mercantile Exchange prompt-month…

European Natural Gas Futures Trading Hit New Highs in March on Russia, Ukraine Volatility

Intercontinental Exchange Inc. (ICE) said Wednesday that natural gas futures trading in Europe set new records last month amid volatility sparked by Russia’s invasion of Ukraine and the ongoing threat it has posed for the continent’s energy supplies. ICE said Dutch Title Transfer Facility (TTF) futures reached new heights in March, when 5.08 million lots…