To shore up its liquidity and maintain its pace during the commodities downturn, National Fuel Gas Co. (NFG) subsidiary Seneca Resources Corp. has entered into a joint development agreement (JDA) with an affiliate of Dallas-based IOG Capital LP to drill up to 80 Marcellus Shale wells across 10,500 acres in Northern Pennsylvania.

Remaining

Articles from Remaining

JPMorgan Exiting Physical Commodities Business

JPMorgan Chase & Co. said Friday it is planning to exit the physical commodities business, including its remaining holdings of commodities assets and its physical trading operations.

Church Group Lifts Leasing Ban, in Talks Over Shell Pipeline

Members of the Pittsburgh Presbytery voted to end a one-year moratorium on shale development, a decision that could potentially open property from the organization’s 150 churches to Marcellus Shale oil and gas leasing.

EQT Boosts EUR Projections in the Marcellus

EQT Corp. released updated information for its investors on Friday, including higher projections for estimated ultimate recovery (EUR) at wells in its core Marcellus Shale acreage, thanks to reduced cluster spacing, longer laterals and a pending deal with Chesapeake Energy Corp.

Industry Briefs

Cheniere Energy Partners LP’s Sabine Pass Liquefaction LLC has engaged 17 financial institutions for credit facilities to fund the remaining debt necessary to develop and place into service the first four trains of the Sabine Pass liquefaction project. “We will amend and upsize the existing term loan A credit facility that was entered into last year for the financing of the first two trains [see Daily GPI, April 17, 2012], extending the available capacity to accommodate four liquefaction trains,” Cheniere said. Obtaining debt financing is one of the last steps to complete before proceeding with construction of trains 3 and 4.

Industry Briefs

A news media tour was held Saturday at the Mayflower, AR, oil spill area under the joint command of local, state and federal officials, as well as ExxonMobil representatives. The event was held to provide an update of the spill, which occurred March 29 when a portion of the ExxonMobil Pegasus Pipeline ruptured. Since then, the portion of the 850-mile oil pipeline that failed has been removed for analysis at an independent laboratory and a new section of pipeline installed, all under state and federal oversight. In ExxonMobil’s most recent daily report the company indicated that cleanup was coming to an end and remediation of the area should begin soon. Monitoring by the company and various agencies has indicated that there has been no contamination of water or air from the spilling of what is estimated to be 5,000 bbl of oil. Besides U.S. Environmental Protection Agency representatives, there have been representatives from the federal Pipeline and Hazardous Materials Safety Administration, the Arkansas Attorney General’s Office and local government on the scene since the cleanup began. Arkansas Attorney General Dustin McDaniel launched an investigation several days after the incident (see Shale Daily, April 3).

El Paso Seeks Willcox Lateral Expansion Start-Up

El Paso Natural Gas, a Kinder Morgan pipeline, has asked FERC for authorization to place the remaining portions of the expansion of its Willcox Lateral into service. The pipeline will make more natural gas available for delivery to power plants in northern Mexico.

Ohio’s Utica Expands to 567 Permits Approved, 268 Wells Drilled

Carroll County and operators for Chesapeake Energy Corp. continue to hold the lion’s share of permits issued and producing wells in the Utica Shale, according to Ohio Department of Natural Resources (ODNR) figures.

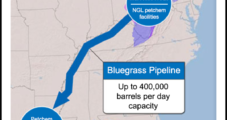

Marcellus NGL Pipeline Would Convert Portion of Texas Gas

Williams and Boardwalk Pipeline Partners LP are partnering on a pipeline project to carry mixed (y-grade) natural gas liquids (NGL) from the Marcellus and Utica shales to the U.S. Gulf Coast as well as the petrochemical market in the Northeast.

Industry Brief

KW Express LLC a partnership of Kinder Morgan Energy Partners LP (KMP) and Watco Companies LLC, has entered into a long-term agreement with Mercuria Energy Trading Co. Inc. to construct a 210,000 b/d crude-by-rail project at the Greens Port Industrial Park on the Houston Ship Channel. The project will allow Mercuria Energy Trading Inc. to source crude from various locations, including Cushing, OK, West Texas, the Bakken Shale area and Western Canada for delivery by rail into the Houston Ship Channel for distribution to various refiners via pipeline and barges. The facility will have the capability to unload and load up to three unit trains per day of crude oil and condensate as well as provide for up to 100,000 b/d of barge loading capacity. KW Express will own 85% of the project and, together with Watco, operate the project once completed. Mercuria will own the remaining 15% interes