A pair of bills designed to tap “affordable natural gas in the MarcellusShale” and bring gas service to more consumers in Pennsylvania has been approved by the state’s Senate and moved to the House of Representatives for consideration.

Ratio

Articles from Ratio

Shale Gas Needs Infrastructure Investment, KKR Exec Says

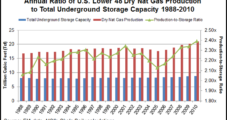

Tapping all of the potential in U.S. shale natural gas isn’t a given; it requires changes to, and investment in, basic energy infrastructure, including an expansion of the U.S. pipeline and storage network, according to KKR & Co. LP.

Private Equity Takes El Paso E&P in $7.15B Deal

A consortium of private equity investors is readying a $7.15 billion leveraged buyout of El Paso Corp.’s exploration and production (E&P) business, which includes an array of liquids-rich U.S. unconventional property that extends across Texas, Louisiana, the Raton Basin and the Rocky Mountains.

Author: U.S. Has Home Team Advantage in Shale Game

Whether one loves or hates hydrocarbon fuels, “they are here to stay,” an energy lecturer and author told a Houston audience. “They provide nine out of 10 units of energy, nine out of 10 units of power…That will remain the case for decades to come. Energy transitions happen over decades or centuries, not over years.” The transition under way now is to natural gas, particularly that from shale plays, he said.

Ziff: Alberta Gas Industry to Suffer Under Royalty Changes

Oil and natural gas prices reached a “near parity” in 2003, trading at a 6:1 ratio, but the discount grew to a third in 2005, and by the end of the first eight months of this year, the oil-versus-gas discount ballooned to 78%, hitting Canada’s gas industry particularly hard, according to energy consultant Ziff Energy Group.

That ’70s Decline Curve: Gas Producers Reprising Oil’s Stagnant Days

Entering 2008, U.S. gas prices could rebound to a 7:1 or even 6:1 ratio with crude oil, depending on the weather, according to analysts at Raymond James & Associates Inc. So $70 oil could mean $10 gas or better. For this bullishness on prices, thank Raymond James’ pessimism about the exploration and production (E&P) industry’s ability to grow production.

Barnett Shale Boosts EOG 2Q

EOG Resources Inc. reported second-quarter net income to common shares of $329.6 million, ($1.34/share), up substantially from $247.6 million, ($1.02/share), in the year-ago period. Strong results in the Barnett Shale were a big part of the improvement. Gas production was up modestly overall and gas liquids prices were up sharply.

LNG Economics Will Lend Support to Gas Prices, Says W&T Exec.

With oil trading at more than an eight-to-one ratio to natural gas in the cash market, the gas industry has little to fear from fuel switching, at least for now, W&T CFO W. Reid Lea told NGI.

NGI The Weekly Gas Market Report

We Won’t Hedge Without a Reason, Says W&T Exec.

With oil trading at more than an eight-to-one ratio to natural gas in the cash market, the gas industry has little to fear from fuel switching, at least for now, W&T CFO W. Reid Lea told NGI.

TransCanada’s Pipe Business Receives 1Q Power Boost

Despite experiencing a slight decline in income from its natural gas transmission business, TransCanada PipeLines Ltd. on Friday said its first quarter 2003 earnings marked an 11% increase over the company’s first quarter 2002 results. The company attributed the higher earnings to the strong performance of the power business and reduced net expenses in the corporate segment, partially offset by lower earnings from the transmission segment.