Crosstex Energy LP plans to build a natural gas processing complex and rich gas gathering system to serve the Permian Basin. The initial investment of $140 million would include treating, processing and gas takeaway solutions for regional producers. The Bearkat project is to be fully owned by the partnership and is supported by long-term, fee-based contracts, Crosstex said. The complex would be near the partnership’s existing Deadwood joint venture assets in Glasscock County, TX, with an initial capacity of 60 MMcf/d, increasing the partnership’s total operated processing capacity in the Permian to 115 MMcf/d. The partnership also is building a 30-mile high-pressure gathering system upstream of Bearkat to serve Glasscock and Reagan counties. The entire project is scheduled to be operational in summer 2014.

permian

Articles from permian

BHP Culling West Texas Assets Through Sales

BHP Billiton Inc. is selling a portion of its Permian assets in the Delaware and Midland basins in two separate packages representing 250,000 acres combined, as it high-grades its West Texas holdings.

Industry Briefs

RCW Energy Serviceshas expanded its water-transfer business serving the Eagle Ford and other shale plays. The company opened an office in Pleasanton, TX, south of San Antonio, to the Eagle Ford and another office in Midland, TX, to serve the Permian Basin. Besides these two plays, RCW serves the Haynesville Shale.

People

Apache Corp.announced several executive changes effective Jan. 1, 2014. COORod Eichleris transitioning to two newly created roles: executive adviser to the chairman and CEO of liquefied natural gas projects and upstream, as well as oversight of gas monetization, and corporate health, safety, environment and emergency response. Permian Basin Region Vice PresidentJohn Christmannis to become COO of North America. International Operations EVPTom Voytovichis becoming COO of International, whileMike Bahorich, chief technology officer, also assumes responsibility for exploration and production technology. Argentina Region Vice PresidentMichael Bosewould take over the Permian Region, whileDavid Chi, manager of Argentina production, would become interim region vice president.Rob Johnstonis to become vice president of the Central Region.

Approach Gets ‘Nice Positive’ From Oil Pipeline Sale

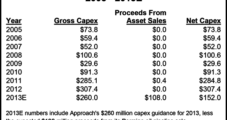

Approach Resources Inc. is selling its 50% interest in an oil pipeline system in the southern Midland Basin for proceeds of $108 million.

Industry Briefs

Sunoco Logistics Partners LP’s (SXL)Sunoco Pipeline LPis holding a binding open season for the Permian Express 2 pipeline to provide additional crude oil takeaway capacity for the Permian Basin. The pipeline would originate at multiple locations in West Texas: Midland, Garden City and Colorado City and have access to several SXL and third-party pipelines to provide producers the ability to reach markets and refineries on the Gulf Coast and in the Midcontinent. “Crude oil production in this basin is projected to increase annually by approximately 200,000 b/d, according to latest industry and consultant estimates,” said SXL CEO Michael Hennigan. “With the ability to reach multiple destinations, including our Nederland terminal, Permian Express 2 is a very attractive, flexible option for shippers.” Information is atwww.sunocologistics.com/permianexpress2.

Linn Bolts On Permian Acreage as Berry Merger Advances

Linn Energy LLC is buying Permian Basin oil and gas properties for $525 million, acquiring 30 million boe of proved reserves (about 70% oil) with a reserve-to-production ratio of about 17 years.

Energen Divests Black Warrior Basin Assets in $160M Deal

Birmingham, AL-based Energen Corp. said this week it has signed an agreement with an undisclosed buyer to sell its Black Warrior Basin coalbed methane (CBM) assets in Alabama for $160 million plus standard closing adjustments. The company expects the sale to close in early October with an effective date of July 1, 2013.

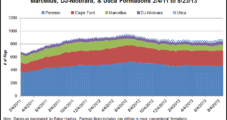

S&P: Any of Several Plays Could Be Next Eagle Ford

Liquids-rich and oil plays have clearly won the hearts and dollars of North American producers. The Eagle Ford and Bakken shales are stars now, but several others are poised to join or possibly eclipse them, according to a recent note by Standard & Poor’s Ratings Services (S&P).

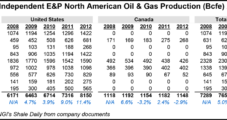

Independents Proving Size Doesn’t Matter

Big Oil’s attempt to take over the North American onshore from U.S. independents so far hasn’t paid off as some would have imagined just a few years ago, with the majors still struggling to capture the kind of profits and production results they may have been anticipating.