The Energy Information Administration (EIA) joined a growing list of analysts raising 2013 natural gas price forecasts, saying in a Short-Term Energy Outlook (STEO) released Tuesday that it expects spot prices, which averaged $2.75/MMBtu at the Henry Hub last year, to climb to an average of $3.52 this year and $3.60 in 2014.

Outlook

Articles from Outlook

EIA Sees U.S. NatGas Production Growing Through 2040

In the early release of its Annual Energy Outlook for 2013 (AEO2013), the Energy Information Administration (EIA) projects that natural gas production will continue to grow during the entire forecast period, with the industry increasingly serving the industrial and electric power sectors, as well as an expanding export market.

Yergin: Unconventionals Creating ‘New Energy Reality’ for U.S.

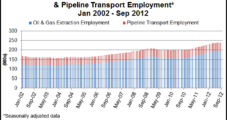

The energy outlook in the United States has “fundamentally changed” because of the revolution in unconventional natural gas and oil production, generating strong job creation, economic growth and government revenues, IHS Inc. said in a new report.

Yergin: Unconventionals Creating ‘New Energy Reality’ for U.S.

The energy outlook in the United States has “fundamentally changed” because of the revolution in unconventional natural gas and oil production, generating strong job creation, economic growth and government revenues, IHS Inc. said in a new report.

Unconventionals Are a Huge U.S. Job Creator, Says IHS

The U.S. energy outlook is “fundamentally changed” because of the revolution in unconventional natural gas and oil production, generating strong job creation, economic growth and government revenues, IHS Inc. said Tuesday.

Raymond James: Natural Gas Rigs to Slow Descent in 2013

Raymond James & Associates Inc. energy analysts last week modestly reduced their near-term outlook for U.S. drilling activity and raised expectations for 2013, but only slightly. Drilling activity in the coming year still is “much lower than consensus expectations,” but the natural gas rig count should begin to stabilize.

Raymond James: Natural Gas Rig Count to Slow Descent in 2013

Raymond James & Associates Inc. energy analysts on Monday modestly reduced their near-term outlook for U.S. drilling activity and raised expectations for 2013, but only slightly. Drilling activity in the coming year still is “much lower than consensus expectations,” but the natural gas rig count should begin to stabilize.

Drilling Technology Crushing Natural Gas, Oil Reserves Assumptions

How much more oomph can new drilling technology bring to the U.S. unconventional revolution? The United States likely will add 11 Bcf/d of natural gas to its reserves this year at total finding, development and completion costs under $3.00/Mcf, while a review of 45,000 unconventional oil wells is finding “tremendous” growth in oil reserves, preliminary IHS Inc. data indicate.

Access Midstream Earnings Boosted by Organic Growth

Access Midstream Partners LP, formerly Chesapeake Midstream Partners LP, reported that net income jumped more than 25% year/year in part because of increased business in the Marcellus and Barnett shales.

Consultancy: Shale-Driven Petchem Expansions to Be Export-Oriented

ESAI Energy’s five-year “Global Industrial Fuels Outlook” concludes that the natural gas liquids (NGL) boom from shale gas development will spur export-oriented investment in petrochemical facilities. Higher petrochemical exports from the United States will target the Latin American market, deterring petrochemical investment in that region.