A unit of Ares Management LP is buying South Texas-focused BlackBrush Oil & Gas LP from EIG Management Co. LLC and Tailwater Capital LLC.

Tag / natural gas

Subscribenatural gas

Articles from natural gas

NatGas by Rail Not on Radar in North Dakota, Official Says

Crude oil by rail transportation continues on its robust path in North Dakota, tied closely to the spread between Brent and WTI prices, but natural gas-by-rail shipment is still just a concept being explored by some of the U.S. railroads, according to Justin Kringstad, director at the North Dakota Pipeline Authority, which keeps track of oil/natural gas transportation.

Another Keystone XL Bill Goes to The Senate

A trio of Senators from both sides of the aisle are co-sponsoring a bill that would authorize construction of the Keystone XL pipeline, but even they don’t think it will get through the current congressional logjam.

New York Moratorium Bill Passes Assembly, Faces Uphill Battle in GOP-Run Senate

Lawmakers in the New York State Assembly have passed a bill calling for a three-year moratorium high-volume hydraulic fracturing (HVHF) and horizontal oil and gas drilling, but time is running out for the bill to also win passage in the state Senate.

Industry Brief

American Energy Partners LP and private equity manager The Energy & Minerals Group have formed American Energy-Midstream LLC to focus on investing in and developing oil and gas infrastructure in basins across the country. The new company said it will focus on building a portfolio of gathering and processing systems and long-haul pipelines aimed at serving American Energy affiliates in the Appalachian Basin, the Permian Basin and the Midcontinent. The move comes after months of American Energy acreage acquisitions since it was founded by Aubrey McClendon in April 2013, including a buying spree earlier this month in which it spent $4.25 billion to expand its Utica Shale footprint and enter both the Permian Basin and southern Marcellus Shale in West Virginia (see Shale Daily,June 9). The deal also marks the latest in a series of investments, mergers and initial public offerings in the midstream sector (see Daily GPI, June 16;Feb. 14).

Steady Physical Market Outshines Soft Futures; July Slides A Nickel

Next-day gas for Thursday delivery changed little overall in trading Wednesday, but far more points were in the black than in the red.

Gas Export Authorization Could Bring on Haynesville Production; Export Pricing a Problem

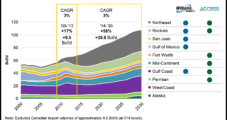

It wouldn’t be a stretch for the United States to ramp up production to serve a 10 Bcf/d liquefied natural gas (LNG) export market by 2020, but whether the prospective exports would cause higher domestic natural gas prices could hinge on whether those exports are tied to Henry Hub gas or to or higher Brent crude equivalents, according to Patrick Rau, Natural Gas Intelligence (NGI) director of strategy and research.

Firm Cash Market Unable to Lift Futures; July Up a Hair

Natural gas for delivery Wednesday posted steady gains at most locations in Tuesday’s trading. Locations impacted by high temperatures, such as the East Coast, saw the greatest gains, with some points advancing more than $1.

Industry Briefs

Kinder Morgan Energy Partners LP (KMP) has expanded its contract with General Dynamics NASSCO for the design and construction of an additional 50,000 deadweight ton liquefied natural gas fueled-conversion-ready petroleum products tanker with a 330,000 bbl cargo capacity. Construction is scheduled to begin in the fourth quarter of 2015 with delivery slated for the second quarter of 2017. The tanker will be constructed as a sister tanker to the four Jones Act tankers KMP currently has under construction at the NASSCO shipyard in San Diego. Construction of the new tanker is supported by a long-term charter with a major shipper and is evidence of its commitment to transporting domestic crude oil, condensate and refined products for the domestic market, KMP said.

Williams Buying Rest of Access Midstream, Creating MLP for ‘Energy Supercycle’

In a “monster deal,” Williams (WMB) said Sunday it is paying about $6 billion to increase its ownership in Access Midstream Partners LP (ACMP). WMB then plans to merge its master limited partnership (MLP), Williams Partners LP (WPZ) with ACMP to create a midstream behemoth that will further mine the “supercycle” in energy.