Enterprise Products Partners LP on Wednesday agreed to buy stakes in affiliates of global marine terminal giant Oiltanking GmbH to enhance its crude and petroleum products storage operations on the Texas Gulf Coast.

Tag / natural gas prices

Subscribenatural gas prices

Articles from natural gas prices

Weather, Technicals Add Bullish Flavor; November NatGas Called A Nickel Higher

November natural gas is set to open 5 cents higher Wednesday morning at $4.17 as traders mull the magnitude and duration of expected cold events and technicians note the attempt to break a key resistance level. Overnight oil markets rose as well.

November Down 10 Cents on Storage; Weakest Hurricane Season in 28 Years Expected

Physical gas for Thursday delivery moved little in Wednesday’s trading with modest losses in California offset by gains in the Northeast and Mid-Atlantic.

Idaho Retail Gas Rates to Increase, PUC Says

Retail natural gas utility charges in Idaho will increase on Wednesday, following action Friday by the state regulatory commission allowing a gas cost adjustment upward for MDU Resources Group’s Boise-based Intermountain Gas Co.

Industry Brief

Mammoth Energy Partners LP, an oilfield services provider, is planning to launch an initial public offering (IPO) to raise up to $100 million, according to a filing with the Securities and Exchange Commission. The partnership was formed in early 2014, but it “has not and will not conduct any material business” until the IPO is launched. No details on when the launch would occur were provided. Mammoth is affiliated with Oklahoma City-based Gulfport Energy Corp. and is sponsored by Wexford Capital LP. Mammoth would provide services in Ohio, Oklahoma and Texas. It would begin with 14 drilling rigs, including 11 horizontals. Wexford and Gulfport plan to contribute the assets of seven affiliated companies as subsidiaries: Redback Energy Services LLC, Redback Coil Tubing LLC, Muskie Proppant LLC, Panther Drilling Systems LLC, Bison Drilling & Field Services LLC, Bison Trucking LLC and Great White Sand Tiger Lodging Ltd. Together, the seven companies posted a net loss of almost $14 million on revenue of close to $133 million in 2013, versus a loss of $2 million on revenue of $8 million in 2012.

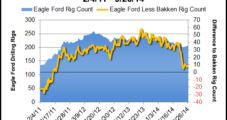

Murphy to Redeploy More Spending to Eagle Ford

Murphy Oil Corp. is selling off $2 billion worth of stakes in Malaysia oil and gas stakes to increase capital spending in the Eagle Ford Shale, among other things.

People

John K. Reinhart, 45, has been named COO for two American Energy Partners LP (AELP) affiliates, American Energy-Utica LLC and American Energy-Marcellus LLC. Reinhart most recently was Chesapeake Energy Corp.’s senior vice president, operations and technical services. Reinhart had worked for former Chesapeake CEO Aubrey McClendon, who founded privately held AELP in April 2013. He was vice president of operations for Chesapeake’s eastern division from 2009-2013. He also had worked for Schlumberger Ltd. for 11 years. Reinhart received a bachelor’s degree from West Virginia University in 1994.

Species Act Has Created Legal Morass, Industry Group Alleges

In its 41 years of existence, the federal Endangered Species Act (ESA) has spurred an unending cycle of lawsuits and closed-door settlements while hamstringing the U.S. Fish and Wildlife Services (FWS) from carrying out its primary mission, according to an analysis released Monday by the oil/gas industry-backed Western Energy Alliance (WEA).

ExxonMobil Issues First Unconventional Drilling Risk Report

ExxonMobil Corp. on Wednesday issued its first report outlining how it assesses and manages risks associated with developing unconventional resources, including through hydraulic fracturing (fracking). Baker Hughes Inc. also has adopted its policy to disclose drilling risks.

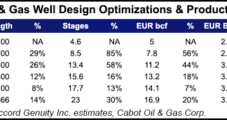

As Marcellus Shale Costs Fall and Volumes Rise, Operators Want More

The Marcellus Shale has for some time now been touted for its low finding and development costs, and even as natural gas volumes in the formation are expected to surpass 16 Bcf/d this month, exploration and production (E&P) companies are bent on getting more for less.