Mammoth Energy Partners LP, an oilfield services provider, is planning to launch an initial public offering (IPO) to raise up to $100 million, according to a filing with the Securities and Exchange Commission. The partnership was formed in early 2014, but it “has not and will not conduct any material business” until the IPO is launched. No details on when the launch would occur were provided. Mammoth is affiliated with Oklahoma City-based Gulfport Energy Corp. and is sponsored by Wexford Capital LP. Mammoth would provide services in Ohio, Oklahoma and Texas. It would begin with 14 drilling rigs, including 11 horizontals. Wexford and Gulfport plan to contribute the assets of seven affiliated companies as subsidiaries: Redback Energy Services LLC, Redback Coil Tubing LLC, Muskie Proppant LLC, Panther Drilling Systems LLC, Bison Drilling & Field Services LLC, Bison Trucking LLC and Great White Sand Tiger Lodging Ltd. Together, the seven companies posted a net loss of almost $14 million on revenue of close to $133 million in 2013, versus a loss of $2 million on revenue of $8 million in 2012.

Tag / natural gas prices

Subscribenatural gas prices

Articles from natural gas prices

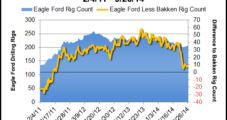

Murphy to Redeploy More Spending to Eagle Ford

Murphy Oil Corp. is selling off $2 billion worth of stakes in Malaysia oil and gas stakes to increase capital spending in the Eagle Ford Shale, among other things.

People

John K. Reinhart, 45, has been named COO for two American Energy Partners LP (AELP) affiliates, American Energy-Utica LLC and American Energy-Marcellus LLC. Reinhart most recently was Chesapeake Energy Corp.’s senior vice president, operations and technical services. Reinhart had worked for former Chesapeake CEO Aubrey McClendon, who founded privately held AELP in April 2013. He was vice president of operations for Chesapeake’s eastern division from 2009-2013. He also had worked for Schlumberger Ltd. for 11 years. Reinhart received a bachelor’s degree from West Virginia University in 1994.

Species Act Has Created Legal Morass, Industry Group Alleges

In its 41 years of existence, the federal Endangered Species Act (ESA) has spurred an unending cycle of lawsuits and closed-door settlements while hamstringing the U.S. Fish and Wildlife Services (FWS) from carrying out its primary mission, according to an analysis released Monday by the oil/gas industry-backed Western Energy Alliance (WEA).

ExxonMobil Issues First Unconventional Drilling Risk Report

ExxonMobil Corp. on Wednesday issued its first report outlining how it assesses and manages risks associated with developing unconventional resources, including through hydraulic fracturing (fracking). Baker Hughes Inc. also has adopted its policy to disclose drilling risks.

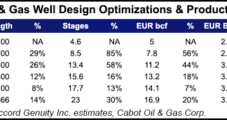

As Marcellus Shale Costs Fall and Volumes Rise, Operators Want More

The Marcellus Shale has for some time now been touted for its low finding and development costs, and even as natural gas volumes in the formation are expected to surpass 16 Bcf/d this month, exploration and production (E&P) companies are bent on getting more for less.

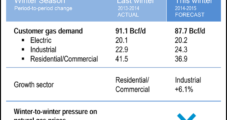

NGSA: Natgas Prices Lower This Winter, While Industrial Demand Seen Up Sharply

Natural gas prices are expected to be lower for the upcoming winter season than a year ago thanks to a combination of factors, including a return to normal winter temperatures, robust domestic production and adequate storage, according to the Natural Gas Supply Association (NGSA).

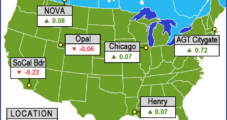

October NatGas Bidweek Quotes Higher Overall in Shoulder-Season Scramble

October bidweek pricing took on the look of an Elvis Presley concert and came out “All Shook Up” as most points nationally were generally a nickel or so on either side of unchanged. At the extremes, however, sellers on Algonquin Citygate and Tennessee Zone 6 200 L enjoyed 72-cent and 71-cent boosts, respectively, to average $3.37 and $3.44, while buyers reveled in a 22-cent drop at SoCal Border to $4.01. The NGI October National Bidweek Average came in at $3.55, up a nickel from September, and 11 cents higher than October 2013’s National Bidweek Average.

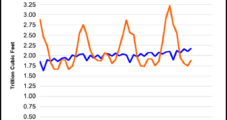

Domestic NatGas Production Surge Continued Higher in July, EIA Says

U.S. natural gas production was 2.65 Tcf in July, up 3.7% compared with 2.55 Tcf in July 2013, and total production through the first seven months of 2014 was 18.26 Tcf, up almost 5% compared to the same period last year, according to the Energy Information Administration (EIA).

People

IHS Vice Chairman Daniel Yergin has been awarded the first James R. Schlesinger Medal for Energy Security by Secretary of Energy Ernest Moniz, which honors an “individual’s distinguished contributions to advancing our understanding of the threats, opportunities and energy policy choices impacting the domestic and international energy security interests of the United States through analysis, policy or practice.” The medal is to be presented annually to individuals outside the Department of Energy (DOE) to complement the existing Schlesinger Award for outstanding performance of a DOE employee in advancing contributions of national importance. Moniz said that Yergin “has made unique contributions to the energy sector debate. His singular influence over the discussion of energy — and public understanding of the history and future trends of energy is unmatched.” Yergin won a Pulitzer Prize for The Prize: The Epic Quest for Oil, Money and Power, which has been translated into 19 languages. Prior to founding Cambridge Energy Research Associates, which was acquired by IHS in 2004, he taught at the Harvard Business School and the Harvard Kennedy School of government.