Wyoming pure-player Ultra Petroleum Corp., which has struggled financially in recent years, will soon begin trading over-the-counter (OTC) after its board decided against trying to regain compliance with Nasdaq listing standards.

Nasdaq

Articles from Nasdaq

Joining Peers, Dominion Offers to Buy Out Midstream Unit

Dominion Energy is making plans to buy out its midstream partnership, duplicating an effort this year by U.S. competitors to avoid an extra tax burden.

Briefs — Colorado Orphan Well Bill

Colorado Gov. John Hickenlooper has signed into law a bill to direct excess environmental-related funds to the long-term mitigation of abandoned oil and natural gas wells. House Bill 18-1098 addresses the adverse impacts from drilling activities administered by the Colorado Oil and Gas Conservation Commission and mandates that any excess funds in the account at the end of each fiscal year not be diverted to a broader state fund.

Rex Energy Again Facing Possible Nasdaq Delisting

Rex Energy Corp. has again received notice from Nasdaq that it is not in compliance with the listing standards of the Nasdaq Capital Market, putting the company in jeopardy of delisting if its plan to meet the exchange’s requirements is not accepted.

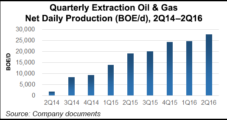

Extraction, First E&P Launch in Two Years, Soars Early in Nasdaq Debut

Denver-based Extraction Oil & Gas LLC, the first U.S. exploration and production company to go public in two years, climbed 15% in its debut on Nasdaq Wednesday after pricing above expectations.

Nasdaq’s NFX Energy Derivatives Platform Goes Live

Making good on their March promise to launch a line of energy futures products by mid-year 2015, Nasdaq announced that its U.S.-based Nasdaq Futures Inc. (NFX) platform went live last Friday with an initial slate of futures and options on oil, natural gas and U.S. power benchmarks, with a fee holiday for the first nine months of trading.

EVEP Says Agreement to Sell Utica Acreage Unlikely By Year’s End

EV Energy Partners LP (EVEP) said that although it has received offers for its acreage in the Utica Shale, the company does not expect to announce an agreement before the end of the year.

Industry Brief

Quest Resource Corp. (QRCP) has been granted its request to continue to be listed on NASDAQ subject to the condition that it file by Aug. 15 its required quarterly reports on Form 10-Q for 3Q2008, 1Q2009 and any required restatements. The exploration and production company and its related partnerships, which are based in Oklahoma City, have agreed to merge and form a publicly traded corporation (see Daily GPI, July 7). The entities have been rocked by scandal in the past year after the former CEO and former CFO allegedly siphoned millions of dollars from the company (see Daily GPI, June 18).

Petro-Canada Boosts Offer, Extending Bidding War Over Canada Southern

Canada Southern Petroleum shares gapped sharply higher on the NASDAQ Wednesday morning and reached a new 52-week high of $13.49 after Petro-Canada announced that its subsidiary Nosara Holdings Ltd. was raising its offer for the shares of the company for a second time to $13/share from $11. Nosara’s original offer in May to Canada Southern shareholders was $7.50, but a bidding war with Canadian Oil Sands and Canadian Superior over the shares raised the stakes significantly (see Daily GPI, June 30).

Crosstex Energy Shares Jump 29% in IPO

Crosstex Energy Inc. shares soared 30%, or $5.85, to $25.35 last Tuesday in an initial day of trading on the Nasdaq National Market under the symbol XTXI. Dallas-based Crosstex, which owns and controls the general partner share of midstream operator Crosstex Energy LP with a 54% stake, priced the initial public offering of 2.3 million shares of common stock at $19.50.