Toronto-based Superior Plus Corp. has completed its merger with fuels distributor Certarus Ltd., handing it natural gas and hydrogen distribution assets across North America. The propane and distillates distributor and marketer has expanded into compressed natural gas (CNG), renewable natural gas (RNG) and hydrogen delivery with Certarus’ network of bulk compression stations and mobile storage…

Mergers and Acquisitions

Articles from Mergers and Acquisitions

Denver’s PureWest Sells Wyoming Natural Gas Reserves to Private Consortium for $1.8B

PureWest Energy LLC, which develops natural gas reserves in Wyoming’s Green River Basin, has struck a $1.84 billion deal to merge with a group of financial buyers. The all-cash transaction is by PW Consortium, a group that includes A.G. Hill Partners LLC, Cain Capital LLC, Eaglebine Capital Partners LP, Fortress Investment Group LLC, HF Capital…

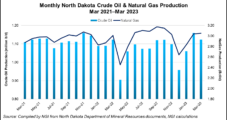

‘Consolidation in the Core’ of Williston as Chord Energy Buying ExxonMobil Assets for $375M

Williston Basin pure-play Chord Energy Corp. has agreed to acquire a package of assets from ExxonMobil subsidiary XTO Energy Inc. in a cash transaction valued at $375 million. The assets span about 62,000 net acres and include “123 estimated net 10,000 foot equivalent locations,” said management of Houston-based Chord. The XTO assets currently are producing…

NRG Urged to Shake Up Strategy Following ‘Worst Deal’ of Past Decade

Elliott Investment Management LP is calling on Houston-based utility giant NRG Energy Inc. to upend its strategy because of “operational and strategic mishaps.” The activist investor, which said it has spent $1 billion to secure a 13% stake, sent a letter on Monday to NRG’s board specifically criticizing a $2.8 billion deal to buy home…

Vital Energy, NOG Adding Permian Delaware Assets for $540M

Vital Energy Inc. and Northern Oil and Gas Inc. (NOG) are teaming up to acquire the assets of Forge Energy II Delaware LLC, an EnCap Investments LP portfolio company based in the Permian Basin, in a $540 million all-cash transaction. The Forge assets in the Delaware sub-basin span nearly 42,000 gross acres across Pecos, Reeves…

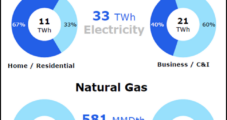

Business Booming for Natural Gas G&P in Oily Onshore Basins, Says Crestwood CEO

It’s a good time to be in the natural gas gathering and processing (G&P) business, particularly in oil-weighted basins such as the Permian, Powder River and Williston, according to Crestwood Equity Partners LP CEO Robert Phillips. Phillips hosted a conference call on Tuesday to discuss first quarter results. Through a series of mergers and acquisitions…

Canada’s Baytex Adding Eagle Ford Heft in $2.5B Ranger Oil Acquisition

Calgary’s Baytex Energy Corp. has agreed to acquire Eagle Ford Shale pure-play Ranger Oil Corp. in a cash, stock and debt deal valued at about $2.5 billion. The merger, slated to close by the end of June, would see Baytex acquire 741 net undrilled locations with inventory life of 12-15 years, management said. These include…

With $1.1B EnVen Takeover, Talos Positions for ‘More Competitive’ CCS Business

Talos Energy Inc. has completed its merger with EnVen Energy Corp., expanding its Gulf of Mexico (GOM) footprint and positioning the independent to advance the growing carbon capture and sequestration (CCS) business. After completing the sale, Talos reported it had an outstanding market capitalization of about $2.5 billion and more than 126 million shares of…

U.S. Oil, Natural Gas M&A Slows in 2022 as Megadeals Dominate

Mergers and acquisitions (M&A) within the U.S. upstream fell to their lowest annual volume in nearly two decades last year, according to new research by Enverus Intelligence Research (EIR). Exploration and production (E&P) firms recorded 160 transactions valued at $58 billion total, the Enverus subsidiary found. This is the lowest number of deals since 2005.…

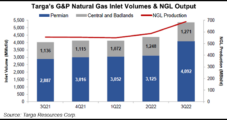

Targa Shelling Out $1B Cash to Boost Permian NGL Pipeline Stake

Targa Resources Corp. has agreed to purchase Blackstone Energy Partners’ 25% interest in Targa’s Grand Prix natural gas liquids (NGL) pipeline for $1.05 billion in cash plus customary working capital adjustments. The transaction, slated to close during the first quarter, would give Houston-based Targa a 100% ownership position in the 1.0 million b/d capacity pipeline.…