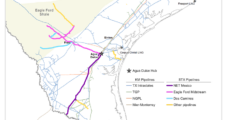

Kinder Morgan Inc. (KMI) has agreed to acquire NextEra Energy Partners LP’s South Texas natural gas business, South Texas Midstream LLC (STX Midstream), for $1.8 billion. The STX Midstream system comprises 462 miles of natural gas pipelines with 4.9 Bcf/d of transport capacity connecting the Eagle Ford Shale with growing demand in Mexico and along…

Mergers and Acquisitions

Articles from Mergers and Acquisitions

Crescent Point Aiming to Become No. 1 Montney E&P with $1.9B Takeover of Hammerhead

Calgary-based Crescent Point Energy Corp. is jumping into the merger frenzy with a goal to transform its portfolio in Western Canada with the $1.9 billion cash-and-stock takeover of crosstown rival Hammerhead Energy Inc. “This strategic consolidation is an integral part of our overall portfolio transformation,” said Crescent Point CEO Craig Bryksa. The assets are in…

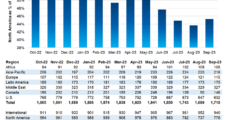

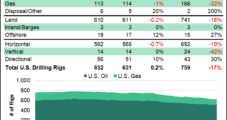

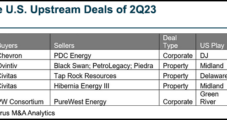

Upstream Dealmaking at Full Throttle with ExxonMobil, Chevron Deals, and More Consolidation Said Likely

Dealmaking in the U.S. oil and natural gas upstream segment was on cruise control between July and September, with an estimated $14 billion spent for 25 transactions, but two mega-mergers announced this month may signal that transactions to year’s end may go into overdrive. A summary of 3Q2023 upstream merger and acquisition (M&A) activity, compiled…

Wave of U.S. E&P Consolidation ‘Good for Halliburton,’ Says CEO

The mega-mergers by the two largest U.S.-based producers – and rumors of more tie-ups to come – are positive for business and demonstrate the value of natural gas and oil long term, Halliburton Co. CEO Jeff Miller said Tuesday. Miller held a conference call to discuss third quarter results for the Houston-based oilfield services (OFS)…

ExxonMobil Creating Permian Juggernaut with Pioneer Natural Merger Valued at $59.5B

As has been speculated for months, ExxonMobil on Wednesday agreed to buy Permian Basin pure-play Pioneer Natural Resources Co. in a mega all-stock transaction valued at $59.5 billion. The implied total enterprise value, including net debt, is estimated at $64.5 billion. “Pioneer is a clear leader in the Permian, with a unique asset base and…

Calgary’s Precision Drilling Merging with CWC to Build North American Rig Fleet

Calgary-based drilling contractor Precision Drilling Corp. is merging its drilling operations with cross-town rival CWC Energy Services Corp., a deal designed to boost the North American rig fleet. The cash-and-stock transaction is worth an estimated C$141 million ($104 million). Precision said it would trade 948,000 of shares, valued at C$88 million ($65 million), as well…

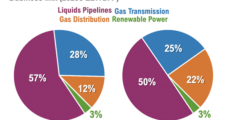

Enbridge CEO Calls Dominion Natural Gas Utility Deal ‘Once in a Generation Opportunity’

Enbridge Inc. agreed late Tuesday to spend $9.4 billion to become the top North American natural gas utility operator in North America with the purchase of three Dominion Inc. systems, which, once completed, would deliver 9.3 Bcf/d to seven million U.S. and Canadian customers. The Dominion systems to be sold, East Ohio Gas Co., Public…

Diamondback’s Viper Energy Building ‘Unparalleled Growth Runway’ with Natural Gas, Oil Royalty Acquisition

Viper Energy Partners LP has entered a deal to substantially expand its Lower 48 mineral and royalty interest footprint through an acquisition from two private equity firms. The Diamondback Energy Inc. subsidiary agreed to acquire about 7,300 net royalty acres from Warwick Capital Partners and GRP Energy Capital for roughly 9.02 million Viper common units…

‘Thunderous Return’ to Upstream M&A as 2Q Dealmaking Tops $24B

Merger and acquisition (M&A) activity in the Lower 48 upstream segment doubled year/year during the second quarter in terms of transacted value, with 20 deals totaling $24 billion, according to the latest tally by Enverus Intelligence Research (EIR). The figure was up from a comparatively sluggish $12 billion transacted during 2Q2022. Dealmaking in 2Q2023 was…

Patterson-UTI Expands Portfolio Further by Snapping Up Blackstone’s Ulterra Drilling

Only weeks after slapping down $5.4 billion to take over NexTier Oilfield Solutions, Patterson-UTI Inc. on Wednesday agreed to buy global drillbit specialist Ulterra Drilling Technologies LP. In the definitive agreement with sponsor Blackstone Energy Partners, Patterson-UTI agreed to pay $370 million cash and trade 34.9 million common shares. Patterson-UTI was trading for around $12.20/share…