Privately held exploration and production (E&P) firms in the Eagle Ford Shale and Midcontinent regions could prove attractive targets for public producers seeking exposure to future strengthening of natural gas prices, according to Enverus Intelligence Research (EIR). EIR’s Andrew Dittmar, principal analyst, highlighted the Eagle Ford, the South Central Oklahoma Oil Province (SCOOP) and the…

Mergers and Acquisitions

Articles from Mergers and Acquisitions

SLB Jumping into Merger Game with ChampionX, Aker Carbon Deals to Accelerate E&P Efficiencies, CCUS

In its second transaction in less than a week, SLB Ltd. agreed Tuesday to buy ChampionX Corp., considered a leader in oilfield reservoir optimization. The all-stock merger with ChampionX, headquartered in The Woodlands north of Houston, was valued at nearly $8 billion. Once the transaction is completed, now expected by year’s end, ChampionX shareholders would…

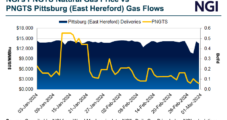

TC Offloading New England Natural Gas System to Advance Strategy

TC Energy Corp. has inked a $1.14 billion agreement to sell the Portland Natural Gas Transmission System (PNGTS) to BlackRock Inc. and Morgan Stanley Infrastructure Partners as it pares debt and streamlines its North American pipeline business. The Calgary-based pipeline giant holds 61.7% ownership of PNGTS, a 295-mile, 290 million Dth/d line. Énergir LP subsidiary…

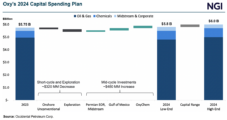

‘No Interest’ in Purchasing or Managing Oxy, Berkshire’s Buffett Tells Shareholders

Berkshire Hathaway may own more than one-quarter of Occidental Petroleum Corp. (Oxy), but the giant investment firm has no plans to take over, Chairman Warren Buffett said. Oxy is an investment “that we expect to maintain indefinitely,” Buffett stated In his annual letter to shareholders. At the end of 2023, Berkshire owned 27.8% of Oxy’s…

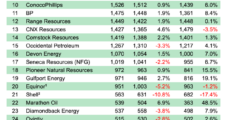

Natural Gas M&A Uptick Said Likely Following Oil-Focused Deal Spree

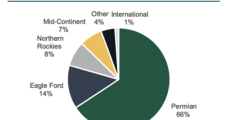

Upstream mergers and acquisitions (M&A) had a banner year in 2023 in the oil and gas sector, with dealmaking reaching a whopping $192 billion total, according to the latest quarterly tally by Enverus Intelligence Research (EIR). While only $6 billion of those transactions were focused on natural gas, versus $186 billion in deals targeting crude…

Natural Gas E&Ps Grab the Baton for M&A in Early 2024 After Record Year of Permian Deals

Could more natural gas-focused exploration and production (E&P) or midstream transactions be in the works after Chesapeake Energy Corp. and Southwestern Energy Co. agreed to combine into the Lower 48’s largest gas producer? Oil-focused dealmaking powered much of the consolidation in the U.S. oil and gas industry in 2023, with associated gas production riding the…

Talos Expanding Deepwater GOM Holdings with $1.29B Takeover of QuarterNorth

Houston-based Talos Energy Inc. is snapping up QuarterNorth Energy Inc., a privately held U.S. deepwater explorer in the Gulf of Mexico (GOM), as it doubles down to expand its “operational breadth and production profile,” CEO Timothy Duncan said. The $1.29 billion cash-and-stock definitive agreement, announced on Monday, would increase Talos output for 2024 by about…

Williams Acquires Hartree’s Gulf Coast Storage Assets For $2B

Midstream giant Williams said Wednesday that it has reached a deal to acquire a portfolio of Gulf Coast natural gas storage assets from an affiliate of Hartree Partners LP for $1.95 billion, capping a busy year for storage acquisitions and expansions. The deal includes six natural gas storage facilities with a total capacity of 115…

Kodiak, CSI Merger to Create Natural Gas Compression Giant, with Permian, Eagle Ford Prowess

The blitz of tie-ups in the U.S. oil and gas industry is continuing, with Kodiak Gas Services Inc. offering to buy CSI Compressco LP in a deal that would become the largest contract compression fleet in the industry with an estimated 4.3 million hp. The all-equity acquisition, valued at $854 million including debt, would deepen…

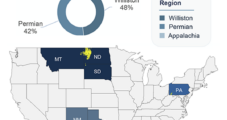

NOG Expanding Natural Gas, Oil Foothold with Permian, Utica Acquisitions

Northern Oil and Gas Inc. (NOG) has entered two deals to acquire interests in upstream assets in the Permian Basin’s Delaware formation and Utica Shale for a combined $170 million in cash. Minneapolis-based NOG specializes in acquiring non-operated minority working and mineral interests in Lower 48 basins. In the Permian Delaware, NOG entered a deal…