Domestic natural gas supplies have been declining but production has a lot more staying power than expected, which should keep the lid on prices through the year, analysts said.

Growth

Articles from Growth

U.S. Natural Gas Output Proving Resilient; Analysts Reduce Price Forecasts

Domestic natural gas supplies have been declining but production has a lot more staying power than expected, which should keep the lid on prices through the year, analysts said.

Appalachian Growth, Haynesville Revival to Keep U.S. Natural Gas Output Strong, IEA Says

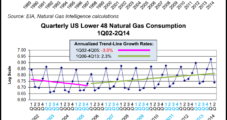

U.S. natural gas production remained on a steep upward trend until early this year, but the supply outlook remains solid, with increasing activity in the Haynesville Shale, together with robust additions from the Northeast, keeping output on a positive trend over the next few years, the International Energy Agency (IEA) reported Thursday.

Appalachian Growth, Haynesville Revival to Keep U.S. Natural Gas Output Strong, IEA Says

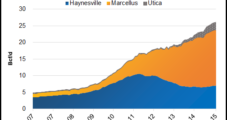

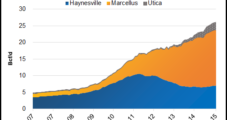

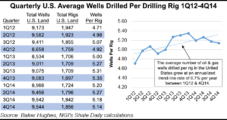

U.S. natural gas production remained on a steep upward trend until early this year, but the supply outlook remains solid, with increasing activity in the Haynesville Shale, together with robust additions from the Northeast, keeping output on a positive trend over the next few years, the International Energy Agency (IEA) reported Thursday.In its Medium-Term Market Report, which provides an analysis of global gas markets, IEA’s researchers are forecasting U.S. production to increase by 114 bcm (4.024 Tcf) until 2020.”Lower oil prices will impact growth from associated and wetter gas where economics have worsened,” according to the U.S. forecast. Increasing activity in the Haynesville, as well as the Marcellus and Utica shales, may trump the the impact, but there are caveats.”Low prices should lead to a re-acceleration in gas demand in the short run, but the long-term outlook is far less clear,” said IEA Executive Director Maria van der Hoeven. “The ability of the industry to adjust and of policymakers to reform will largely determine the role of gas in the global energy mix…While today’s low oil prices have realigned oil-linked gas prices with demand and supply balances, there is no guarantee that this will remain the case. Oil prices may rise again, and both consumers and producers would benefit from taking a far-sighted approach. “The dramatic drop in oil prices “raises questions about the implication for the trajectory of gas output,” the report said. The oil rig count has plunged more than half since its peak in mid-October 2014. The Eagle Ford and the Permian — the two key sources of associated gas production growth — have not escaped this trend.U.S. producers have cut capital expenditures (capex), and that in turn has pressured drilling activity. Service costs are falling but they have so far lagged behind adjustments in budgets, IEA said. “Deferring well completions, which account for 50-70% of the total cost of drilling a well, is another capex-deferring technique often used…A large backlog of uncompleted wells means a steeper production fall on the way down, but a faster recovery on the way up.”The rig count is only one measure, however. The other is the amount of oil and gas volume produced by each rig. And here is where the U.S. producers have outdone themselves, the report said.”Rig productivity has continued to increase on the back of improvements in drilling efficiency and hydraulic fracturing techniques. While gains differ from play to play, the trend of rising efficiency has proved significant and sustained. Increased well productivity will partly offset the impact on production of lower drilling.”A huge adjustment is under way throughout the entire U.S. oil supply chain, and the net impact on output remains difficult to judge, according to IEA.On balance, the agency expects U.S. light, tight oil production to continue to increase over the medium term, albeit at a slower pace than before.”As a result, associated gas production is also set to increase moderately throughout 2020, falling in the earlier part of the forecast period, but recovering afterwards. Texas associated gas production additions are estimated at about 13 bcm (459 Bcf) in 2014. Growth there might well slip into negative territory toward 2016, if oil prices do not recover.”Even so, total domestic gas output looks robust on two main factors: continued strong output from Appalachia and flattening decline rates in other dry gas plays, specifically the Haynesville.Growth from the Marcellus/Utica is likely to moderate this year mainly because of transportation bottlenecks, not low oil prices, IEA said.The rebirth of the Haynesville is notable, IEA said. The play, which straddles East Texas and North Louisiana, had been the largest producing shale play in the United States until 2012, when the Marcellus overtook it. At its peak, the Haynesville was producing 100 bcm (3.53 Tcf), IEA said. As producers have renewed their interest in the play, and using new drilling techniques, decline rates from legacy wells have stabilized.U.S. demand in the industrial sector is seen on an upward trend through 2020, rising by 1.7% per year, supported by ample and cheap natural gas feedstock, the report said.”However, the sharp fall in oil prices is chipping away at the economic advantage of its largely gas-based petrochemical sector in relation to naphtha-based industries, more prevalent globally. Similarly, concerns over the scale of natural gas liquids expansion as rig activity falls back sharply could lead to a slowdown of investments, resulting in a deceleration of industrial gas demand growth in the latter part of the forecast period.”Several uncertainties surround this year’s report, van der Hoeven said. “Technological advances, geopolitical changes and strategic policy shifts can all give rise to an unexpected re-shaping of gas markets…Let us not forget that only a few years ago, the United States looked destined to remain a net liquefied natural gas (LNG) importer for decades to come. In the next five years, the United States will become a meaningful LNG exporter. In dynamic markets such as those for gas, change is sometimes the only constant.”

Wisconsin Energy Rides Gas, Proppant Growth, CEO Says

With a greater emphasis on natural gas with its pending Integrys Energy acquisition (Daily GPI, Aug. 1, 2014), Milwaukee-based Wisconsin Energy (WE) is gearing up for gas infrastructure growth with one of its drivers being the state’s leading role as sand supplier for proppant used in hydraulic fracturing (fracking).

North America Oil to ‘Loom Even Larger’ on Global Stage as Prices Strengthen, Says IEA

The oil market’s price correction may pause the North American supply “party,” but it won’t bring it to an end as the roaring 2020s kick off an era of even more abundance than earlier forecast, the International Energy Agency (IEA) said Tuesday.

Demand Has Fingerprints on Oil Price Crash, IHS Exec Says

Even though overly robust production is the prime suspect, it may have had an accomplice — weak demand — in last year’s mugging of global crude oil prices, according to an executive with consultancy IHS.

Permian Pure-Play Concho Cuts 2015 Spending by One-Third

Midland, TX-based Concho Resources Inc. (CXO) cut its 2015 capital spending plans to $2 billion from $3 billion due to low commodity prices and projected 16-20% year-over-year production growth. Analysts following the company gave the news a thumbs-up and praised the Permian Basin producer for its “capital discipline.”

Some Private E&Ps Foresee 500-Plus Onshore Oil Rigs Idled in Two Months

Several publicly traded onshore exploration and production (E&P) companies are signaling big cutbacks to their 2015 capital spending plans, and some private operators are expecting to see activity reined in sooner rather than later.

NatGas Supply-Demand Convergence Coming, But It Will Take A While

A flood of proposed pipeline capacity along with liquefied natural gas (LNG) exports will spur demand toward convergence with booming supply between 2025 and 2030 and driving U.S. economic growth, several natural gas experts told an industry group in Chicago Monday.