Cash market prices overall fell 4 cents Thursday with the greatest weakness demonstrated by northeast and eastern points. To avoid unnecessary volatility, traders typically make their deals prior to the Energy Information Administration’s (EIA) release of inventory data, and in Thursday’s trading, cash and futures markets moved in opposite directions. In the West, Colorado industry groups reported that raging wildfires in the state were not impacting oil and gas.

Greatest

Articles from Greatest

Texas RRC Adopts Well Casing, Fracking Rule Changes

The Railroad Commission of Texas (RRC) amended its oil and gas well construction requirements rule (Statewide Rule 13) to clarify requirements related to casing, cementing, drilling, well control and completions. The changes take effect Jan. 1, 2014 and apply to any wells drilled on or after that date.

Portion of Trunkline Could Be Bakken Oil Bridge to Gulf

Enbridge Inc. and Energy Transfer are planning to develop a pipeline to carry crude oil from Western Canada and the Bakken Shale, by way of the Patoka, IL, hub to the eastern Gulf Coast in a project that would convert portions of the Trunkline Gas Co. LLC natural gas system to oil service.

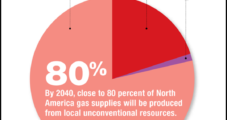

Unconventional Gas to Dominate North American Supply by 2040, ExxonMobil Says

By 2025 natural gas is expected to overtake coal as the second most used fuel worldwide and North America will have transitioned to become a net energy exporter, while by 2040 global energy demand will have increased by almost 35% from 2010 levels, according to ExxonMobil Corp.’s Outlook for Energy: A View to 2040, which wasreleased Tuesday.

Northeast Weakens, Rockies Strong, And Futures Soft

Overall physical gas Wednesday was unchanged on average with Rockies points the major winners and volatile Northeast points showing the greatest losses. Midwestern and eastern locations were largely flat. At the close of futures trading the October contract had fallen 1.1 cent to $2.762 and November was 1.6 cent lower at $2.945. October crude oil plunged $3.31 to $91.98/bbl.

Northeast Points Rocket Higher; Other Locations Post Gains As Well

Overall cash prices advanced on average by six cents Monday with the greatest gains reserved for a handful of Northeast points as forecasted hot weather combined with delivery restrictions. Texas and California points recorded nominal gains. At the close of futures trading August had fallen 7.3 cents to $2.801 and September had shed 7.6 cents to $2.793. August crude oil added $1.33 to $88.43/bbl.

Northeast Strong As Traders Grapple With BidWeek; Futures Gain

The overall cash market rose on average about 4 cents in Tuesday’s trading with Northeast points showing the greatest gains and eastern points adding a couple of pennies. Weather forecasts call for an enduring two-week period of above normal temperatures throughout the nation’s mid-section, and at the close of futures trading the about-to-expire July contract rose 7.3 cents to $2.767 and August added 7.3 cents as well to $2.807. August crude oil rose 15 cents to $79.36/bbl.

Nearly All Points Slide; Futures Waft Lower

The cash market slumped another five cents on average Friday with virtually all locations posting losses and Northeast locations suffering the greatest setbacks as hyper-warmth was forecast to return to the area on Monday. California points also weakened. Futures held relatively steady and at the close May had eased two-tenths of a cent to $1.989 and June had fallen eight-tenths of a cent to $2.084. May crude oil dropped 81 cents to $102.83/bbl.

Shale Called ‘Source of Uncertainty’ for U.S. Gas Market

Shale gas production is projected to increase to the point where it becomes the dominant domestic gas supply over the next two decades, but it brings with it the “greatest source of uncertainty” facing North American gas markets, according to the Deloitte Center for Energy Solutions.

Barclays: U.S. to Remain LNG Wallflower Next Year

The greatest amount of liquefied natural gas (LNG) regasification capacity being added worldwide this year is coming online in North America — where it’s needed least, according to analysts at Barclays Capital. Meanwhile, LNG cargo takes by Asian countries are poised for growth next year while some Asian countries will find their regasification capacity to be wanting.