EnerVest Ltd., the second biggest leaseholder in Ohio’s Utica Shale, plans to sell the majority of its property in several packages in hopes of fetching $6 billion or more.

Focuses

Articles from Focuses

West Virginia DEP Seeks to Cut Deficit Through $10,000 Permit Fee

Increased drilling activity in West Virginia’s Marcellus Shale area and a dramatic decline in revenues from natural gas drilling permits have prompted the Department of Environmental Protection (DEP) to seek a larger piece of the state’s budget pie, a larger staff to handle about 750 active wells and a dramatic increase of horizontal permitting fees.

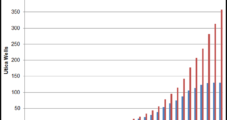

With Pinedale Output Strong, Ultra Readies for Marcellus Growth

Ultra Petroleum Corp., which focuses its natural gas exploration and development in the Pinedale Anticline of Wyoming and the Pennsylvania portion of the Marcellus Shale, on Friday reported that its 4Q2009 profits beat Wall Street estimates and output hit record levels.

With Pinedale Output Strong, Ultra Readies for Marcellus Growth

Ultra Petroleum Corp., which focuses its natural gas exploration and development in the Pinedale Anticline of Wyoming and the Pennsylvania portion of the Marcellus Shale, on Friday reported that its 4Q2009 profits beat Wall Street estimates and output hit record levels.

With Pinedale Output Strong, Ultra Readies for Marcellus Growth

Ultra Petroleum Corp., which focuses its natural gas exploration and development in the Pinedale Anticline of Wyoming and the Pennsylvania portion of the Marcellus Shale, on Friday reported that its 4Q2009 profits beat Wall Street estimates and output hit record levels.

Industry Briefs

Midland, TX-based Legacy Reserves LP, which focuses its exploration and production in the Permian Basin and in the Midcontinent, has ended discussions with Apollo Management VII LP to take the company private. The Legacy board of directors’ conflicts committee said it was unable to reach an agreement with Apollo and that it would be in the best interests of its unitholders to remain a publicly held partnership. To improve its liquidity position and mitigate the risk of falling commodity prices, Legacy, which was formed in 1993, also has entered into new oil and natural gas commodity swaps.

Wyoming’s Pinnacle Sells Gas Assets to Raise Cash

Pinnacle Gas Resources Inc., a junior explorer that focuses on coalbed methane (CBM) resources in the Rocky Mountains, has sold some undeveloped acreage and gas gathering assets in Wyoming for $3.2 million. Some of the proceeds will be used to pay down debt.

Senate Clarifies Carbon Capture Tax Credit for Producers

The energy portion of the nearly $888 billion Senate economic stimulus package, like its House counterpart, focuses almost exclusively on tax credits and direct investments for renewable fuels and electric transmission facilities, but one tax credit has been carved out for traditional oil and natural gas producers. Producers would be eligible for a $10/ton tax credit if they can prove that the carbon dioxide (CO2) injected to enhance oil and gas recovery has been permanently sequestered in a field.

Stimulus Bill Clarifies Carbon Capture Tax Credit for Producers

The energy portion of the nearly $888 billion Senate economic stimulus package, like its House counterpart, focuses almost exclusively on tax credits and direct investments for renewable fuels and electric transmission facilities, but one tax credit has been carved out for traditional oil and natural gas producers. Producers would be eligible for a $10/ton tax credit if they can prove that the carbon dioxide (CO2) injected to enhance oil and gas recovery has been permanently sequestered in a field.

Industry Briefs

Indigo-Energy Inc., a junior explorer that focuses on prospects located in the Upper Devonian sand formations of Kentucky, Pennsylvania and West Virginia, plans to spend $686.4 million to develop about 135,000 acres in the Illinois Basin, an emerging natural gas play that straddles portions of southern Illinois, southwestern Indiana and western Kentucky. The Illinois Basin covers about 60,000 square miles. Indigo, based in Henderson, NV, obtained the funds through a loan agreement with BJ Petro Inc., a Nevada corporation. Indigo also won mineral rights in Greene County, PA, and in Monongalia County, WV.