Utilities in the United States are trending toward using master limited partnerships (MLP) as a vehicle to increase investment in natural gas infrastructure, according to Fitch Ratings Inc.

Fitch

Articles from Fitch

U.S. Shale Gas Means Cheaper Power For Mexico, Fitch Says

Access to shale natural gas from the United States will lower Mexico’s historically high electricity prices and encourage the siting of industrial operations in Mexico, according to an analysis by Fitch Ratings.

Fitch Says Recent E&P Bankruptcies Push Default Rate to Record 27%

Four recent bankruptcy filings by exploration and production (E&P) companies have pushed the trailing 12-month (TTM) U.S. high-yield (HY) bond default for E&Ps to a record 27%, while the TTM default rate for the energy sector is approaching 14%, according to Fitch Ratings Service.

Key Financial Lifelines Slipping Away For Some E&Ps, Fitch Says

Distressed debt exchanges, a lifeline used since last spring by many struggling natural gas and oil producers, may no longer be a viable alternative to prevent being swept away by washed out commodity prices, according to Fitch Ratings.

There’s Growth in NatGas Utilities, Fitch Says

Local distribution companies’ (LDC) rusty old steel pipes have a silver lining: they offer organic growth opportunities that can often be easily financed through the rate base, according to Fitch Ratings. This is helping make LDCs the growth play in the broader utilities sector.

Many E&Ps Still Accessing Capital Markets, With Cuts ‘Relatively Light,’ Fitch Says

The sky-is-falling scenario that producers were expected to face as crude oil prices collapsed last year has yet to make a big dent in lending, according to Fitch Ratings.

Marcellus Operators Continue Facing Squeeze of Low NatGas Prices

A sample of six Marcellus Shale operators taken by Fitch Ratings shows, not surprisingly, that weak realized natural gas prices related to an ongoing supply glut in the Northeast could further inhibit production growth in the play next year.

Former Shale Gale Blows A Cold Wind on State Revenues

Low natural gas prices and a consequent pullback from drilling have hit Arkansas hard. During the fiscal quarter ended Sept. 30, gross natural gas severance tax revenues were less than half what they were during the year-ago period. Arkansas isn’t alone, but the oil/gas downturn is affecting producing states differently, Fitch Ratings said.

Methanol Prices Face Economic Headwinds, Fitch Says

It could be a long road back for deflated methanol prices, and recent declines in oil and oil-linked commodities, and overall global economic headwinds are likely to continue to pressure methanol prices in the near term, according to Fitch Ratings.

Fitch Says Shale Efficiencies Partly to Blame For Weak NGL Prices

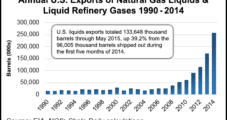

Although several new ethane crackers and export facilities are on the horizon, Fitch Ratings said U.S. natural gas liquids (NGL) prices will remain weak for the rest of the year and into the medium term, but they could also get worse, in part due to oil and gas producers becoming more efficient with shale drilling.