Fitch Says Shale Efficiencies Partly to Blame For Weak NGL Prices

Although several new ethane crackers and export facilities are on the horizon, Fitch Ratings said U.S. natural gas liquids (NGL) prices will remain weak for the rest of the year and into the medium term, but they could also get worse, in part due to oil and gas producers becoming more efficient with shale drilling.

In non-rating action commentary released last Friday, the ratings service warned that if NGL prices were to remain low for a longer period of time, it could harm the ratings or outlook it gives to midstream companies with gathering and processing operations.

“Gas processors with contract profiles heavily weighted towards percent of proceeds, percent of liquids, or keep-whole type contracts are being significantly affected in the current low price environment and have been underperforming,” Fitch said. “Ratings pressure on these processors would likely increase if NGL prices remain low. Fixed-fee processors remain stable across their operations, though volume exposure is a rising concern, particularly if production declines.”

According to Fitch, earlier this month prices for propane, butane and natural gasoline were 60% lower than August 2014, and the decline was steeper than that of West Texas Intermediate (WTI) crude. Meanwhile, ethane prices were down 6% over the same period.

“Low realized prices for NGLs continue to be an issue for U.S. exploration and production [E&P] producers as well as midstream issuers, and have contributed to the weak results seen in 2Q2015,” Fitch said.

Fitch said it expects ethane prices will get a boost once several new ethane crackers come online between 2017 and 2018. Although not specifically mentioned by Fitch, these should include facilities being built or expanded by:

Fitch added that the expansion of Enterprise Products Partners LP’s liquefied petroleum gas (LPG) export terminal on the Houston Ship Channel, as well as the construction of Phillips 66’s LPG terminal in Freeport, TX, are expected to balance some of the NGL surplus. The former is expected to be completed by the end of 2015, the latter by mid-2016 (see Daily GPI, July 30; Nov. 4, 2013).

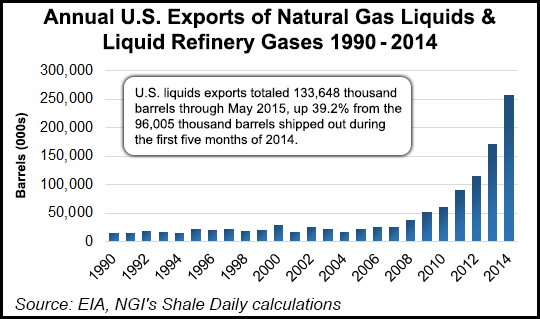

According to data from the U.S. Energy Information Administration, NGL exports have more than quadrupled within the last five years, from 59.8 million bbl in 2010 to 257.9 million bbl in 2014.

“Stronger seasonal demand as a result of crop drying and a cold winter heating season could help prop up propane prices near term, but we believe any improvement is expected to be limited,” Fitch said.

But working against all of the aforementioned projects and trends, Fitch said, are “the ongoing efficiency gains” oil and gas producers are making in U.S. shale formations. It cited faster and cheaper completions, longer laterals and improved well designs.

“As a result, U.S. shale producers continue to improve unit economics and migrate down the cost curve, which allows them to operate at lower breakeven prices and tolerate low NGL prices,” Fitch said.

Consequently, Fitch said it was concerned that NGL prices could remain weak “for a protracted period” or get worse, especially if there is “significant macroeconomic weakness.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |