Tellurian Inc. has made another executive leadership change, this time choosing to part ways with its CEO, as it tries to fast track development of its Driftwood LNG project. The Houston-based company has been awash in personnel and strategy shifts since December, when its board of directors moved to dismiss co-founder and executive chairman Charif…

Fid

Articles from Fid

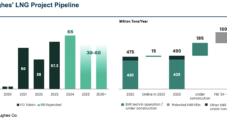

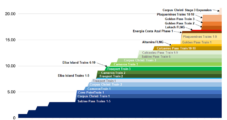

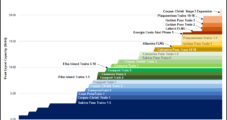

Baker Hughes Forecasting LNG FIDs Slowing, but Overall Massive Pipeline to 2030

The world is on track to achieve 800 million metric tons/year (mmty) of LNG capacity by 2030, with Baker Hughes Co. expecting to grab a major slice of the market, executives said Wednesday. CEO Lorenzo Simonelli, joined by CFO Nancy Buese, discussed the Houston-based oilfield service giant’s latest quarterly results and the outlook during a…

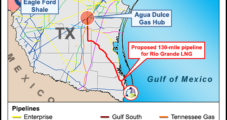

NextDecade Looks to Reach FID On Rio Grande LNG Train 4 By End of 2024

As the early phases of construction ramp up in Texas, NextDecade Corp. is plotting course for a final investment decision (FID) on an expansion of its Rio Grande LNG export facility later in the year. Houston-based NextDecade disclosed it has secured a credit agreement with the Japanese financial giant MUFG Bank Ltd. for a $50…

Mexico Pacific Nears Sold-Out Capacity for Saguaro LNG with Woodside SPA

Woodside is further diversifying its LNG portfolio with more U.S.-sourced gas from a new supply agreement with Mexico Pacific Ltd. (MPL), tallying another major offtaker for the proposed Mexican terminal. Woodside has inked a 20-year, 1.3 million metric ton/year (mmty) sales and purchase agreement (SPA) for offtake from the Saguaro Energia LNG terminal on a…

NextDecade Targets 2024 to Sanction Rio Grande LNG Expansion

As construction of the first phase gets underway in South Texas near the Mexico border, NextDecade Corp. is looking to finalize plans by mid-2024 to expand its Rio Grande LNG export project. The Houston-based firm broke ground in Brownsville on the first three trains of the facility last month, which could add 17.6 million metric…

More Global LNG FIDs Tracking for 2023 and Beyond, Says Baker Hughes CEO

The opportunities for global natural gas, including LNG, look strong in the near term, with a “number of projects” likely to be sanctioned for the next few years, Baker Hughes Co. CEO Lorenzo Simonelli said Wednesday. During the conference call to discuss second quarter 2023 results, Simonelli said recent customer discussions to advance more liquefied…

U.S. LNG Projects Face Uncertainty as DOE Toughens Stance on Exports – Listen Now to NGI’s Hub & Flow

Click here to listen to the latest episode of NGI’s Hub & Flow. Rapidan Energy Group’s Alex Munton, director of global gas service, joins NGI’s Senior LNG Editor Jamison Cocklin to discuss how U.S. regulators are stepping up efforts to more closely scrutinize liquefied natural gas export authorizations as global trading booms. They analyze the…

NextDecade Reaches FID on Rio Grande LNG First Phase, Gives Bechtel Notice to Proceed

NextDecade Corp. has officially reached a final investment decision (FID) and given a notice to proceed on construction of the first phase of its Rio Grande LNG (RGLNG) facility. The Houston-based company disclosed Wednesday afternoon that it had secured $18.4 billion for the 17.6 million metric ton/year (mmty) first phase, making it what the company…

Commonwealth LNG In Final Stretch of Commercialization, Anticipates FID This Year

As Commonwealth LNG LLC awaits its last regulatory approval from the U.S. Department of Energy (DOE), management said it has also entered the final stages of commercializing the more than 9 million metric tons/year (mmty) project ahead of a final investment decision (FID) later this year. Executive Chairman Paul Varello told NGI the company is…

Permian’s Growing Relationship with Gulf Coast Exporters Driving Demand for Nitrogen Control, Chart Says

As associated gas from the Permian Basin continues to help drive a boom in LNG projects, removing the relatively high levels of nitrogen is growing into a lucrative business for Chart Industries Inc., according to company executives. Generally, liquefied natural gas facilities limit the percentage of nitrogen in the end product to 1%. While some…