Jera Co. Inc. has signed on as an offtaker from Venture Global LNG Inc.’s CP2 export project under development in Cameron Parish, LA. Jera, Japan’s largest power company, has agreed to buy 1 million metric tons/year (mmty) of liquefied natural gas from CP2. Jera would buy the super-chilled fuel for a term of 20-years on…

Fid

Articles from Fid

FERC Authorizes Amended Design for Sempra’s Cameron LNG Expansion

The Federal Energy Regulatory Commission has authorized Sempra Infrastructure’s amended design for the expansion of its Cameron LNG facility as the firm aims for a final investment decision (FID) this summer for the project. In early 2022, Sempra filed a request to amend the approval for its proposed 6.75 million metric tons/year expansion of the…

Venture Global Sanctions Second Phase of Plaquemines LNG Project

Venture Global LNG Inc. said Monday that it would go forward with the second phase of its Plaquemines export terminal under development in Louisiana after securing $7.8 billion in financing. The final investment decision (FID) comes less than 10 months after the first phase was sanctioned. All together, Venture Global said it would invest $21…

Sempra Aims for Port Arthur LNG FID Early Next Year as Offtaker Interest Grows

Riding the wave of strong U.S. natural gas demand and project development milestones, Sempra management reported it is now targeting a final investment decision (FID) for its Port Arthur LNG project during 1Q2023 and is currently marketing its proposed expansion. San Diego-based Sempra’s liquefied natural gas subsidiary, Sempra Infrastructure, has been developing the project southeast…

LNG Buyers Said Still Hunting for U.S. Volumes, but Project Costs, Complications Are Rising

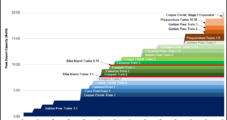

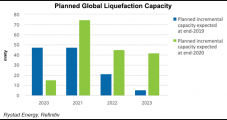

The market dynamics that have helped boost U.S. LNG export projects since the early spring are likely to continue, at least in part, but the next wave of terminal development will have added financing and inflationary hurdles, according to analysts with Poten & Partners. The Houston-based consultancy has been tracking a flurry of contracting and…

Another Russian LNG Project Slated for 2023 FID as More Output Targeted for China

Yakutia LNG, a 17.7 million metric ton/year (mmty) liquefaction project proposed for the Russian republic of Yakutia, is planned to start up in 2027 to deliver liquefied natural gas (LNG) from Russia’s Far Eastern coast to China. If the Russian government gives permission for the Yakutia project to export LNG, it could help Russia towards…

Woodside Sanctions $12B Scarborough LNG Project in Australia

Woodside Petroleum Ltd. said Monday that it would go ahead with the $12 billion Scarborough liquefied natural gas (LNG) project, sanctioning a large dry gas field off the coast of Western Australia and an expansion at its Pluto export facility. The Scarborough field is about 230 miles off the coast. It would feed a second…

After Missing FID Deadline for Goldboro LNG, Pieridae Reviewing ‘Strategic Alternatives’

The developer of the proposed Goldboro liquefied natural gas (LNG) project on Canada’s east coast has announced an evaluation of “strategic alternatives” for the $10 billion development after it missed a deadline to sanction the project June 30. “We have not been able to meet all of the key conditions necessary to make a final…

Bleak Picture Painted for Increasingly ‘Expensive and Fragile’ LNG Projects

Liquefied natural gas (LNG) suppliers may cede valuable market share to renewables as project costs skyrocket and buyers become more concerned about emissions associated with the super-chilled fuel, according to the Global Energy Monitor (GEM). The nonprofit, which tracks energy projects around the world, in a recent report said North American suppliers are particularly vulnerable…

Sempra Now Eyeing Port Arthur LNG FID in 2022 and Looking to ‘Green Up’ Site

Sempra Energy may push a decision on whether to sanction the Port Arthur, TX, natural gas export project to 2022 as it looks to reduce the greenhouse gas (GHG) footprint. “We continue to work with partners and customers to focus on options to reduce the projects GHG profile and continue improving its competitive position in…