ExxonMobil will add more natural gas – including LNG – into the portfolio, both in the United States and overseas, as long as they are “advantaged investment opportunities,” according to CEO Darren Woods. During the quarterly conference call on Friday, Woods was asked whether more liquefied natural gas assets would be added to the portfolio…

Tag / Exxonmobil

SubscribeExxonmobil

Articles from Exxonmobil

ExxonMobil Greenlights Another Stabroek Project Offshore Guyana

ExxonMobil keeps powering ahead in its offshore Guyana program even as a contract dispute and geopolitical tensions cast a shadow over the oil-rich project. The company made a final investment decision for the Whiptail development, its sixth project on the offshore Stabroek block. It has the necessary approvals in place and the offshore platform is…

ExxonMobil, Shell Cite Weaker Natural Gas Prices in 1Q Previews

ExxonMobil profits for the first three months of this year are expected to dip sharply year/year and be down sequentially in part because of weak natural gas and oil prices, the integrated major said. Shell plc also has revised its expectations. In a Securities and Exchange Commission Form 8-K filing, ExxonMobil noted that commodity prices…

Amid Oil and Natural Gas Consolidation Frenzy, Chevron’s Guyana Mega-Deal Facing Hurdles

ExxonMobil is trying to put a stop to Chevron Corp. and its bid to enter the lucrative Guyanese offshore oil and natural gas patch. The company has filed for arbitration, claiming Chevron’s bid to snap up Hess Corp.’s Guyana assets goes against a contract clause that grants ExxonMobil a right of first refusal. Last October,…

Guyana Government Calls Oil, Natural Gas Investments ‘Safe’ Amid Venezuela Saber-Rattling

Guyanese officials have played down any threats to foreign investment while talking up the possibility of developing the country’s natural gas resources. At the Guyana Energy Conference and Supply Chain Expo last week, Vice President Bharrat Jagdeo told the audience, “I want to assure you that your investments will be safe.” The reassurances come amid…

ExxonMobil’s Global Trading Arm Finding Opportunities in Volatile Natural Gas, Oil Prices

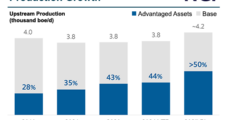

ExxonMobil’s goal to advance its natural gas and oil trading arm is gaining momentum, as the company eyes more opportunities in the global market, CEO Darren Woods said Friday. Woods discussed the supermajor’s fourth quarter and full year results during a wide-ranging conference call. “We saw energy prices and refining margins start to normalize in…

ExxonMobil Says Activist Shareholders’ ‘Extreme Agenda’ Designed to Diminish Existing Operations

ExxonMobil is seeking to prevent some investors from using what it called a “Goldilocks Trojan Horse” strategy to diminish existing business operations. In a lawsuit filed earlier in January, the integrated major requested judicial relief to exclude a shareholder proposal by Arjuna Capital and Follow This. The lawsuit was filed in the U.S. District Court…

Natural Gas M&A Uptick Said Likely Following Oil-Focused Deal Spree

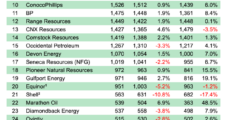

Upstream mergers and acquisitions (M&A) had a banner year in 2023 in the oil and gas sector, with dealmaking reaching a whopping $192 billion total, according to the latest quarterly tally by Enverus Intelligence Research (EIR). While only $6 billion of those transactions were focused on natural gas, versus $186 billion in deals targeting crude…

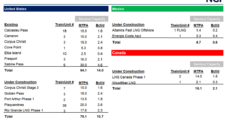

ExxonMobil Agrees to Purchase More LNG From Saguaro Energia Export Project in Mexico

Mexico Pacific Ltd. LLC (MPL) has signed another long-term agreement to sell an ExxonMobil affiliate more LNG from MPL’s Saguaro Energia export project under development on the country’s west coast. MPL said Tuesday it would sell 1.2 million metric tons/year (mmty) of the super-chilled fuel from Saguaro’s third liquefaction train to ExxonMobil LNG Asia Pacific…

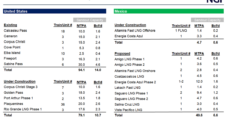

Energy Majors, Traders Betting on Big Future for LNG

Energy majors and commodities traders are playing an outsized role in supporting a global LNG export buildout that ultimately could saturate the market with the super-chilled fuel later this decade, bring prices down and stoke future demand. About 150 million metric tons/year (mmty) of additional liquefaction capacity is under construction across North America and in…