The return of LNG volumes in Australia, as well as stable natural gas and oil trading, should boost Shell plc’s results in the first quarter, the integrated major said. Liquefied natural gas volumes are forecast to climb to 7.0-7.4 million metric tons (MT) in 1Q2023 from 6.8 MT in 4Q2022. Shell, in a preview of…

Ethane

Articles from Ethane

Technip To Supply Cracker Furnaces for $8.5B Golden Triangle Project in Texas

Technip Energies has been contracted to supply ethane cracker furnaces for the 2 million metric ton/year (mmty) Golden Triangle Polymers project planned southeast of Houston. The $8.5 billion joint venture between Chevron Phillips Chemical (CP Chem) and QatarEnergy was sanctioned in November. In addition to the cracker, the facility in Orange would include two 1…

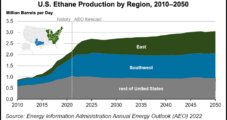

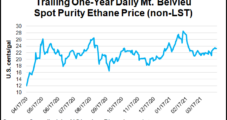

U.S. Ethane Production Seen Climbing 16% in 2022, Says EIA

Production of ethane, a natural gas liquid (NGL), should grow by about 9% in the United States during the second half of 2022 compared to first-half levels, according to an Energy Information Administration (EIA) forecast. “Ethane is consumed almost exclusively as a feedstock in petrochemical plants known as steam crackers to produce ethylene, a precursor…

TotalEnergies, Borealis Start Up Texas Ethane Cracker

TotalEnergies SE and Borealis AG reported last week they have begun commercial operations at their nearly $2 billion ethane cracker in Port Arthur, TX. The companies built the ethane cracker, with an ethylene production capacity of 1 Mt/y, at TotalEnergies’ refinery in Port Arthur via their Bayport Polymers LLC 50/50 joint venture (JV). “This investment…

NGL Extraction Process Designed to Cut Emissions, Cost

Calgary-based Gas Liquids Engineering Ltd. (GLE) has designed a natural gas liquids (NGL) extraction process that could require less energy and lower operating costs. GLE is touting the split absorber reflux (SABR) process, which extracts propane and ethane from natural gas. “In many cases, SABR can recover propane and ethane with lower energy use, and…

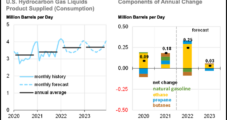

Ethane Consumption Said on Pace to Lead U.S. Petroleum Growth Through 2023

Ethane is expected to be the most widely consumed petroleum product in the United States in 2023, and it is already outpacing jet fuel and propane, according to the Energy Information Administration (EIA). Ethane demand has grown every year since 2010 in the United States, EIA said, including a 50,000 b/d year/year increase in 2021.…

Braskem Reports Record U.S. Ethane Imports at Mexico Plant, with New Terminal Coming Soon

Brazilian petrochemicals giant Braskem SA reported record imports of ethane from the United States to its Braskem Idesa polyethylene plant in Mexico for a second straight quarter in the fourth quarter of 2021, and it expects a new ethane import terminal at the site to start up by 2024. CFO Pedro Freitas described a dramatically…

Appalachia NGL Feedstock Looking to Support Region’s Petrochemical Growth In 2022

A long awaited petrochemical project is set to begin operations in the Appalachian Basin in 2022, and a second major investment in the region could get the green light this year.

Dow Readying Net-Zero Ethane Cracker in Alberta

Dow Inc. announced a plan Wednesday to develop a net-zero carbon emissions ethane cracker for an industrial customer in Alberta as a capacity expansion by its Fort Saskatchewan complex northeast of the provincial capital in Edmonton. The cracker, fueled by natural gas, would be capable of producing 1.8 million tons/year of ethylene. Environmental renovations of…

Pemex, Braskem Idesa End Ethane Supply Spat, to Partner on Import Terminal

Mexican national oil company Petróleos Mexicanos (Pemex) and Braskem Idesa have reached agreement on an ethane supply deal, bringing to an end a year-long dispute that threatened to shutter the largest petrochemicals operation in Latin America. The Brazil-based Braskem SA unit said on Tuesday Pemex would supply 30,000 b/d of ethane to the Etileno XXI…