Fitch Ratings Inc. downgraded the credit ratings of Petróleos Mexicanos (Pemex) in mid July, citing the Mexico state-owned oil company’s high debts, multiple accidents and “continued weak operating performance.” Fitch’s Saverio Minervini, a senior director in the Latin America corporate finance group, spoke with NGI’s Mexico GPI about the reasons for the downgrade. “This was…

Debt

Articles from Debt

Energy, Business Groups Urge Permitting Reform as GOP Suggests Tying Vote to Debt Ceiling

U.S. businesses across the country, including natural gas and oil groups, are urging Congress to enact “meaningful, durable permitting reform” by summer’s end. The U.S. Chamber of Commerce organized the collaboration of more than 200 state and local chambers, as well as business, policy and labor organizations. In a letter sent to Congressional leaders, the…

Abraxas Emerges as Permian Delaware Pure-Play, with Angelo Gordon Fund in Control

With a private equity (PE) infusion, Abraxas Petroleum Corp. is ready to restart oil and natural gas development in the Permian Basin as a Delaware pure-play, the San Antonio, TX-based independent said Monday. The company, which has faced financial issues over the last couple of years, said it completed a strategic review to consider its…

With Oil Prices Up and Interest Rates Low, U.S. E&Ps Issue More Debt

While bank borrowing remains light, publicly traded U.S. exploration and production (E&P) companies are boosting the amount of debt and equity issued via capital markets, taking advantage of continued low interest rates and recovered stock valuations. Companies are using proceeds to pay down more expensive legacy debt but also positioning themselves to ramp up production…

Continental May Exceed 2021 Oil, Natural Gas Production Guidance in Midcontinent as Net Debt Falls

Continental Resources Inc. said Tuesday it is on track to meet or exceed its 2021 full-year oil and natural gas production guidance. The Oklahoma City-based exploration and production (E&P) company also indicated that it has lowered its total debt by 10% since the end of 2020. In an update ahead of its 1Q2021 earnings call…

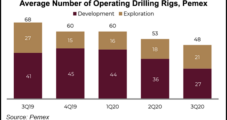

Tax Break or No, Mexico’s Pemex Likely to Require More Government Support, Fitch Says

Mexican state oil company Petróleos Mexicanos (Pemex) would require more government support over the coming years if it wants to increase capital expenditures (capex) without taking on more debt, even if proposed tax breaks for the firm are passed by legislators, according to Fitch Ratings. Senator Armando Guadiana, a member of President Andrés Manuel López…

Oil, Natural Gas Industry Said ‘Exploiting’ Federal Relief through Historic Borrowing Spree

The oil and natural gas industry has embarked on a lavish borrowing spree this year, underpinned by a federal bailout of corporate debt markets in response to Covid-19, a new analysis has found. Oil and gas companies, already in dire financial straits before the pandemic, have issued $99.3 billion in debt in U.S. markets since…

Chesapeake Energy Reports Progress on Debt Reduction

Chesapeake Energy Corp. said Wednesday it is making progress on debt reduction measures nearly three months after warning that low commodity prices could push the company into bankruptcy.

Chesapeake Energy Reports Progress on Debt Reduction

Chesapeake Energy Corp. said Wednesday it is making progress on debt reduction measures nearly three months after warning that low commodity prices could push the company into bankruptcy.

Chesapeake Takes Action to Fight Debt Load

Chesapeake Energy Corp. on Wednesday announced a series of financial measures aimed at better managing the debt on its books and keeping the company afloat a month after it warned of a possible bankruptcy.