The oil and natural gas industry has embarked on a lavish borrowing spree this year, underpinned by a federal bailout of corporate debt markets in response to Covid-19, a new analysis has found.

Oil and gas companies, already in dire financial straits before the pandemic, have issued $99.3 billion in debt in U.S. markets since March 23, said the report authored by nonprofit organizations Friends of the Earth, Public Citizen and BailoutWatch.

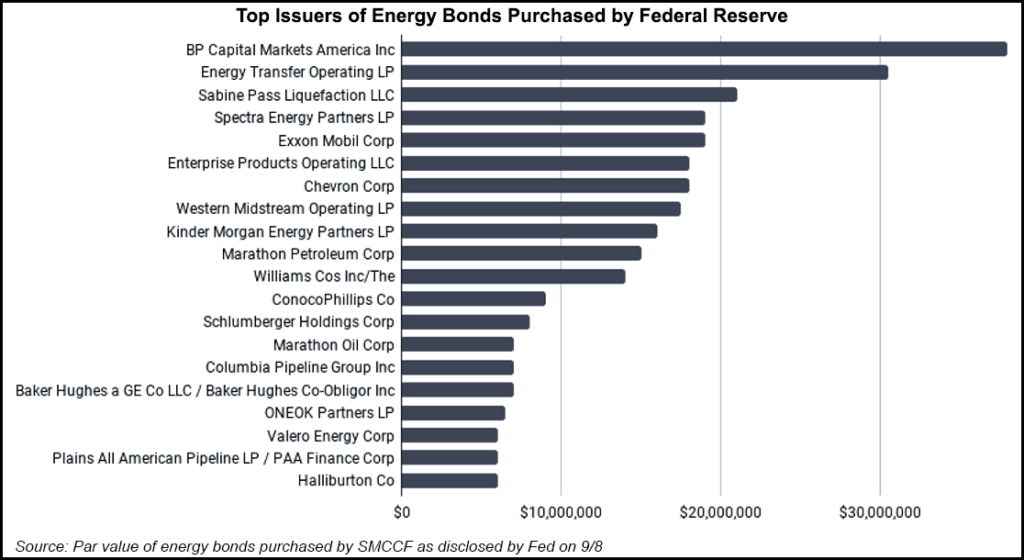

On that date, the Federal Reserve Bank, aka the Fed, announced it would purchase corporate bonds for the first time ever through a program called the Secondary Market Corporate Credit Facility (SMCCF) as an emergency measure to keep financial markets afloat amid the pandemic-driven economic downturn.

The oil and gas industry,...