Linn Energy LLC and LinnCo LLC are acquiring Berry Petroleum Co. for $4.3 billion, including debt, in a transaction said to be the first-ever acquisition of a C-corporation by an upstream limited liability company (LLC) or master limited partnership (MLP).

Customary

Articles from Customary

Piceance Sale Makes Antero an Appalachia Pure Play

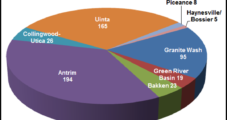

Antero Resources is selling all of its natural gas and pipeline assets in the Piceance Basin for $325 million in cash plus assumption of its Rocky Mountain firm transportation obligations in order to focus more on the Marcellus and Utica shales.

Williams Partners Buys Caiman’s Midstream Unit, Plans Utica JV

Williams Partners LP on Monday agreed to pay $2.5 billion to buy Caiman Energy’s midstream business, giving it a much bigger footprint in the natural gas liquids (NGL) portion of the Marcellus Shale in northern West Virginia, southwestern Pennsylvania and eastern Ohio. The two companies also are teaming up to build a midstream business in the Utica Shale.

Industry Brief

Williams Partners LP has agreed to acquire the Laser Northeast Gathering System and other midstream businesses from Delphi Midstream Partners LLC for about $750 million. Laser is composed of 33 miles of 16-inch diameter gas pipeline and associated gathering facilities in Susquehanna County, PA, as well as 10 miles of gathering pipeline in southern New York. The acquisition is supported by existing long-term gathering agreements that provide acreage dedications and volume commitments. As production in the Marcellus Shale increases, the Laser system is expected to reach a capacity of 1.3 Bcf/d, said Williams Partners, which plans to fund the purchase with $300 million in cash and 7.5 million common units. The deal, which the partnership said it earlier was pursuing (see Shale Daily, Dec. 5), is subject to customary regulatory approvals.

Superior’s Complete Takeover Adds Leverage in Pressure Pumping

In a merger that would create a formidable onshore oilfield services company, Superior Energy Services Inc. on Monday agreed to pay $2.7 billion in cash and stock to buy Complete Production Services Inc. — a 62% premium to Complete’s closing share price on Friday.

Industry Brief

Well servicing contractor Key Energy Services Inc. has agreed to acquire Edge Oilfield Services LLC and Summit Oilfield Services LLC for $300 million in stock and cash, plus reimbursement of up to $40 million of capital spending in the Eagle Ford Shale. Edge primarily rents hydraulic fracturing stack equipment. It also provides well testing services, rental equipment such as pumps and power swivels, and oilfield fishing services. Closing is expected during this quarter subject to customary conditions.

Industry Briefs

Copano Energy LLC plans to expand the processing capacity of its Houston Central plant in Colorado County, TX, to accommodate increased demand from producers in the Eagle Ford Shale. Houston-based Copano plans to build a 400,000 Mcf/d cryogenic processing plant, bringing the facility’s total processing capacity to 1.1 Bcf/d. The new plant is estimated to cost $145 million and could be in service by early 2013. Copano, a midstream natural gas company with operations in four states, owns assets including nine processing plants with more than 1 Bcf/d of combined processing capacity and 22,000 b/d of fractionation capacity.

Encana Taking Piece of Kitimat LNG Project

Encana Corp. is taking a 30% stake in the planned Kitimat liquefied natural gas (LNG) export terminal on the west coast of central British Columbia (BC) and its associated gas pipeline, the Calgary-based company said Friday. Encana is joining units of Apache Corp. and EOG Resources Inc. in the project, which will target Asian markets with western Canadian gas supplies.

Calpine Files Restructuring Plan, Disclosure to End Bankruptcy in ’07

San Jose, CA-based Calpine Corp., the aggressive independent power plant developer/operator, filed its joint plan of reorganization and the customary disclosure statement with the U.S. Bankruptcy Court for the Southern District of New York, saying it expects to have the plan confirmed by the court and creditors during the fourth quarter this year.

Shell Greases Motor Oil Sales with Pennzoil Buy

The transaction, subject to approval by Pennzoil’s stockholders and customary regulatory reviews, is expected to close in the second half of 2002 and is expected to add to Shell’s earnings and cash flow in the first full year after it is completed. Shell’s estimated pre-tax benefits from the transaction will total about $140 million a year by 2004. One-time transaction costs were estimated at $100 million.