ConocoPhillips expects to grow oil and natural gas production by 5% and spend $5.5 billion a year on capital expenditures (capex) through 2020, but executives said the company could maintain flat production, including in the U.S. onshore, to leave room for dividends in case oil prices decline.

Tag / Conocophillips

SubscribeConocophillips

Articles from Conocophillips

Doing ‘More For Less,’ ConocoPhillips Slashes 2017 Capex 10%

ConocoPhillips 3Q2017 earnings were up for a second consecutive quarter, even as production declined, according to the Houston-based independent, which said Thursday it has cut its 2017 capital expenditures (capex) budget by 10%.

ConocoPhillips Quietly Testing Permian, But M&A ‘Not a Priority’

An executive with ConocoPhillips said the company is taking its time to test and understand the geology of the Permian Basin, following the same approach it used to develop its position in the Eagle Ford Shale, but that merger and acquisition (M&A) activity is “not a priority.”

ConocoPhillips Mothballing Kenai LNG Until Market Improves

ConocoPhillips, unable to find a buyer for its Kenai natural gas export facility in Alaska, plans to shutter operations until market conditions improve.

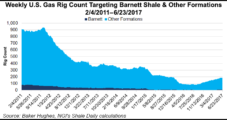

ConocoPhillips Exiting Gassy Granddaddy Barnett in $305M Deal

ConocoPhillips on Thursday continued its turn away from natural gas and to more oil-weighted projects after snagging $305 million from an affiliate of Miller Thomson & Partners LLC for its legacy gas-rich Barnett Shale portfolio.

ConocoPhillips Bidding Farewell to Gassy San Juan Basin in $3B Deal With Hilcorp

Houston-based ConocoPhillips, the largest operator in the natural gas-rich San Juan Basin, agreed Thursday to sell the portfolio for up to $3 billion to an affiliate of Hilcorp Energy Co.

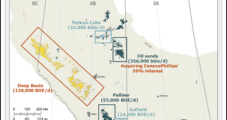

Cenovus Doubling Canada Output, Adding Gas-Rich Montney in $13.3B Deal With ConocoPhillips

Calgary-based Cenovus Energy Inc. is taking full control of some Western Canadian oilsands assets and adding three million net acres to its natural gas-rich Deep Basin portfolio in a transformative $13.3 billion (C$17.7 billion) transaction with ConocoPhillips.

ConocoPhillips Growing Dividend, Adding Rigs in Lower 48

ConocoPhillips reported a net loss of $3.6 billion in 2016, but the company continued its shift toward unconventional production by dispatching additional rigs to the Permian Basin, Bakken and Eagle Ford shales, and plans to have 11 rigs deployed in the Lower 48 in the next few weeks.

ConocoPhillips Selling LNG Plant in Kenai, AK

ConocoPhillips has put a “for sale” sign on its liquefied natural gas (LNG) export terminal in Kenai, AK. For 47 years, the plant was the only LNG export facility in North America; it is one of the longest-operating LNG plants in the world.

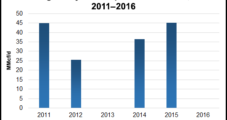

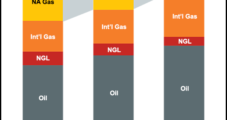

ConocoPhillips Eschews North American NatGas to Accelerate in Permian, Bakken, Eagle Ford

Houston-based ConocoPhillips is marketing up to $8 billion of assets, primarily natural gas-rich properties in North America, to make way for more global investments elsewhere, including in Texas and North Dakota, executives said Thursday.