ConocoPhillipshas completed an estimated $600 million sale of subsidiaryTrinidad and Tobago Holdings LLCtoNational Gas Company of Trinidad and Tobago Ltd.The subsidiary holds a 39% stake in Phoenix Park Gas Processors Ltd., which operates a natural gas midstream facility at Point Lisas, Trinidad. The Houston operator expects to recognize an after-tax gain of about $290 million. Including the latest transaction, ConocoPhillips said it has received around $14.1 billion by selling nonstrategic assets as part of its 2012-13 disposition program, which originally was to pare about $8.5 billion (seeDaily GPI,May 17). Between January and June, ConocoPhillips received $3.8 billion in proceeds from completed sales, with the remainder expected by the end of the year.

Tag / Conocophillips

SubscribeConocophillips

Articles from Conocophillips

Eagle Ford, Bakken, Permian Production Soars 47% for ConocoPhillips

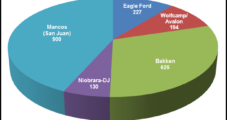

ConocoPhillips saw its combined production in the Permian Basin, Eagle Ford and Bakken shales nearly double during 2Q2013, and it expects to see future growth from its holdings as it transitions to multi-well pad drilling and experiments with tighter well spacing and hydraulic fracturing (fracking) stages.

Summertime in Alaska Means LNG Project Field Work

Summer field work is under way for the effort by producers ExxonMobil Corp., BP plc and ConocoPhillips, and pipeliner TransCanada Corp. to build a liquefied natural gas liquefaction and export facility in southern Alaska.

Poland Nixes Shale Gas Taxes Until 2020

In an attempt to lure foreign investment back to its shale natural gas plays following several high profile defections, the country’s finance minister said a severance tax on unconventional production will take effect in 2015 but no tax would be levied until 2020.

Shale Market Approaching ‘Guillotine Moment’

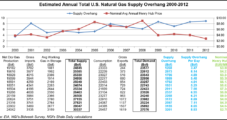

The torrent of natural gas production coming out of North America’s shale plays reminds Jim Duncan, chief analyst and commodity market strategist at ConocoPhillips Gas & Power, of the opening lines of “A Tale of Two Cities,” Charles Dickens’ epic novel of the French Revolution.

Shale Market Approaching ‘Guillotine Moment’

The torrent of natural gas production coming out of North America’s shale plays reminds Jim Duncan, chief analyst and commodity market strategist at ConocoPhillips Gas & Power, of the opening lines of “A Tale of Two Cities,” Charles Dickens’ epic novel of the French Revolution.

EDF Buys ConocoPhillips’ Midwest C&I Gas Portfolio

Europe’s EDF Trading has acquired ConocoPhillips’ Midwest commercial and industrial (C&I) natural gas portfolio, the EDF Group subsidiary said Thursday. Financial details of the transaction were not disclosed.

Chesapeake Offers Voluntary Layoffs

Chesapeake Energy Corp. on Friday has offered a “voluntary separation program” for some of its employees as part of efforts to improve efficiencies and reduce costs. The layoffs, the third round since June, would remove about 2% of Chesapeake’s workforce of nearly 12,500.

Continental Buying in the Bakken, Selling Noncore Conventional Assets

Continental Resources Inc. has signed separate agreements to buy producing and undeveloped properties in the Bakken Shale for $650 million, and to sell land and assets in its east region for $125 million.

Continental Increases Bakken Position Through Wheatland Oil Purchase

Continental Resources Inc.’s shareholders have approved the company’s purchase of Wheatland Oil Inc.’s core assets in the Bakken Shale, a stock deal valued at about $276 million.