ExxonMobil is signaling it will post stronger results during the third quarter because of higher commodity prices, while rival Shell plc also is expecting rebounding profits but lower LNG output because of scheduled maintenance. In Form 8-K filings with the U.S. Securities and Exchange Commission, the integrated majors outlined their projections for the third quarter,…

Tag / Commodity Prices

SubscribeCommodity Prices

Articles from Commodity Prices

Brent Returning to Above $90/bbl Early Next Year, EIA Says

Brent crude oil prices once again are expected to reach $90/bbl-plus by the second quarter of next year amid falling global inventories, and prices for the benchmark would likely average $92 for full year 2023, according to updated modeling from the Energy Information Administration (EIA). In its latest Short-Term Energy Outlook (STEO), published Tuesday, the…

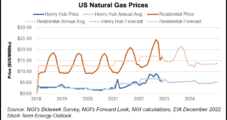

Natural Gas Costs Surge For Consumers Even as Overall Energy Inflation Eases

Natural gas futures soared over the summer months, driving up costs for utilities that bought gas ahead of the fall months and then passed along the hikes to consumers, new federal data show. More inflation lurks as winter weather and heating demand near. The U.S. Department of Labor on Thursday (Oct. 13) said overall consumer…

Citing Prices, Demand, EIA Expects Household Natural Gas Costs to Rise This Winter

A result of both higher retail prices and higher forecast consumption, the Energy Information Administration (EIA) expects U.S. households to spend more on energy this winter compared with the 2021-22 heating season, with the largest increase for homes that heat with natural gas. The agency’s latest Winter Fuels Outlook, included in its updated Short-Term Energy…

Schlumberger Sees Ongoing ‘Resilient’ Upstream Growth in North America, Elsewhere

Constrained availability of oilfield services (OFS) supply capacity in North America, and increasingly internationally, rank among ongoing “tailwinds” for natural gas and oil prices, management at Schlumberger Ltd. said Friday. The OFS giant sees “a decoupling of upstream spending from potential near-term demand volatility, resulting in resilient global oil and gas activity growth in 2022…

Cenovus Sees Continued Jolt for Oil, Natural Gas Prices and Uncertainty Overseas

Calgary-based oilsands producer Cenovus Energy Inc. is predicting a bumpy ride for North American oil and natural gas supply and for prices in light of Covid-19 relapses and Russia’s invasion of Ukraine. “Current fundamentals suggest a tight market will persist” for natural gas, management said as part of the 1Q0222 results. “But this could be…

Schlumberger Forecasting Multi-Year Upcycle in Oil, Natural Gas Investments

The world’s top oilfield operator, Schlumberger Ltd., is anticipating oil and natural gas demand to push “successive years of market growth,” with the upcycle now in full gear, CEO Olivier Le Peuch said Friday. “As demand continues to strengthen and new investments are committed to diversify energy supply, the duration and scale of this upcycle…

Calgary’s Calfrac Says Russian War Injects ‘Risk and Uncertainty’ for Global Operations

Calfrac Well Services Ltd., a Calgary-based specialist in hydraulic fracturing that works in Canada, as well as Argentina, Russia and the United States, said a revival in drilling last year and commodity prices provide momentum, but there is uncertainty on the horizon. “A prolonged period of underinvestment in the upstream sector, in combination with a…

Supercycle Underway for Natural Gas, Oil Markets, Says Schlumberger CEO

A steady recovery in global energy demand, combined with tighter natural gas and oil supplies, are creating favorable conditions for activity in the year ahead, Schlumberger Ltd. CEO Olivier Le Peuch said Friday. The largest oilfield services (OFS) company in the world unveiled its strong fourth quarter results, with Le Peuch detailing the outlook and…

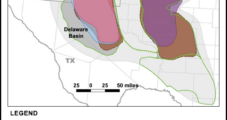

Permian to Bolster New Mexico Budget with 77% Jump in Oil, Natural Gas Revenue Forecast

Higher-than-expected oil and natural gas production, as well as stronger prices, are giving New Mexico’s coffers a boost, the state’s Legislative Finance Committee (LFC) recently reported. The committee also anticipates Fiscal Year (FY) 2021 oil output of 408 million bbl, or 1.12 million b/d — a 10.8% year/year increase. “Global consumption and demand for oil…