NGI Archives | NGI All News Access

Study: Shales, Oilsands to Hit Refiners With a ‘Dumbbell’

Increasing crude oil supplies from shale plays coupled with Canadian oilsands imports will challenge the U.S. refining system in ways the industry had not anticipated, according to a new study from Turner, Mason & Co. (TMC).

Most shale crudes are light-sweet crudes, super-light crudes and condensates. Most Canadian oilsands crude comes to market as “dilbit,” a combination of very heavy bitumen crude and a diluent, usually a very light naphtha or natural gasoline. While some refineries started planning for the Canadian dilbit a few years ago and are now completing upgrades to run more heavy crude, refiners did not anticipate the surge in U.S. light crudes, TMC said. The result is a mismatch between U.S. refinery crude oil supplies and refining capacity, TMC said.

“In effect, U.S. crude oil supplies are being dumb-belled,” said TMC President Mike Leger. “By that we mean crude oil streams high percentages of both light and heavy ends and a scarcity of middle-range material, such as diesel, jet fuel and gas oils. With the coming onslaught of shale crudes on the light end and oilsands crudes on the heavy end, it will be increasingly difficult to avoid the dumbbell.”

TMC examines the phenomenon in its “2012 North American Crude Oil Outlook,” which includes details on major producing basins, midstream infrastructure and the best markets for different crude streams.

“Growing crude oil supplies and more than a dozen new pipeline projects to bring those supplies to Gulf Coast markets are good news for refiners,” said Leger. “U.S. refiners will enjoy a feedstock price advantage relative to most of the world. But there will be challenges that result from the shifts in crude quality.

“As many refineries move to a lighter crude slate, they could see a reduction in capacity by as much as 10%. Ultimately, the U.S. refining system could lose the equivalent of two or three average size refineries unless hardware investments relieve the bottlenecks. In addition, production of diesel, distillate fuel oil and jet fuel will fall, cutting out much of the lucrative middle distillate export market.”

According to TMC, currently the highest margin refined products for most refiners come from middle distillates including diesel, heating oil and jet fuel. Requirements to lower the sulfur content of these products have reduced world supply and U.S. exports have quadrupled in the last five years to more than 1 million b/d as net world demand for ultra-low sulfur diesel has increased.

However, shale crudes yield significantly less diesel and other middle distillates than traditional light domestic and foreign crudes. Instead, they have higher gasoline and naphtha yields, TMC said. Consequently, diesel supplies and exports will decline and will be replaced by increasing gasoline supplies and exports.

“As refiners scramble to handle the changes in crude yields, some will produce excess volumes of light intermediate refinery streams (reformer feed and light straight run), while others will find themselves short of heavier intermediate streams, such as FCCU [fluid catalytic cracking unit] feed. This will result in lucrative trading opportunities to match refinery feedstock surpluses and shortages around the country,” TMC said.

Most of the crude oil growth is coming from the shales, or tight oil plays such as the Bakken, Eagle Ford, Niobrara and emerging Utica Shale. However, high prices for crude have also stimulated production in the Permian and Anadarko basins, as well as other traditional oil plays, TMC noted. In fact, the Gulf of Mexico has the highest projected growth trajectory for crude, the firm said, and more crude is on its way to the United States from the booming Canadian oilsands.

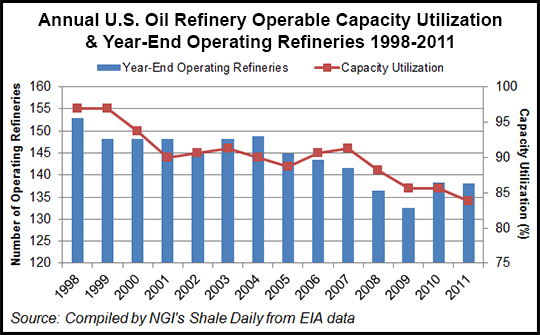

According to the Energy Information Administration, both the number of U.S. refineries in operation and the capacity utilization of those refineries have been in a downtrend since the 1990s.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |