Shell Vows to Appeal Dutch Ruling to More Quickly Slash CO2

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |

Natural Gas Prices

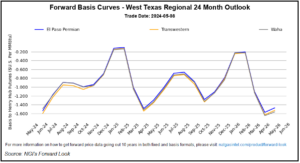

North American natural gas forwards rallied across the 2024 strip during the May 2-8 trading period as sagging production readings and an incrementally supportive LNG export outlook stirred bullish optimism. Benchmark Henry Hub set the tone, with June fixed prices rallying 25.5 cents week/week to reach $2.194/MMBtu, according to NGI’s Forward Look. Negative Basis In…

May 10, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.