A spike in oil and natural gas prices should lead to a sharp increase in first quarter results for Shell plc, but its exit from Russia is likely to be a one-time $4-5 billion writedown, the London-based major said Thursday.

In its 1Q2022 preliminary results, the world’s largest liquefied natural gas (LNG) trader said gas trading gains were forecast to exceed sequential profits. Earnings from global oil trading also were set to be “significantly higher.”

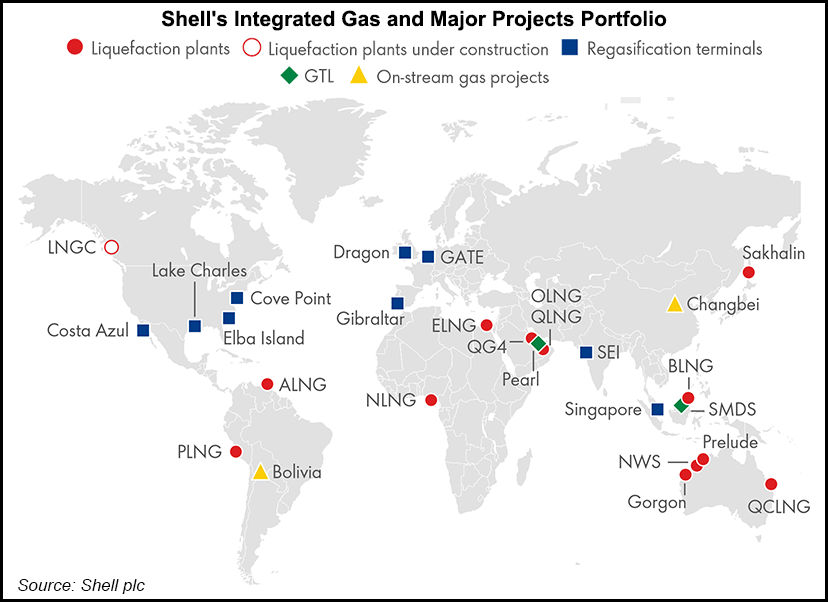

Fuel sales averaged 4.3 million b/d in the quarter, versus 4.5 million b/d in 4Q2021, Shell said. LNG liquefaction volumes were eyed as being slightly higher sequentially, averaging 7.7-8.3 million metric tons (mmt). During 4Q2021, liquefaction volumes totaled more than 7.9 mmt.

“Trading and optimization results for...