Infrastructure | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Robust European Storage Levels Seen Threatening Marginal LNG Suppliers

The world’s sinkhole for liquefied natural gas (LNG) is starting to bubble over, and the glut of new supply expected to come online next year will struggle to find a home, placing “considerable pressure on the short-run economics of marginal suppliers across the world,” according to Wood Mackenzie.

Those were sobering words from Murray Douglas, the firm’s research director of European gas & LNG, who discussed Europe’s current gas supply situation and the deluge of incremental LNG capacity forecast to come online during a GasTalk webinar last week.

But those words rang loud and clear when Singapore-based Pavilion Energy Pte Ltd. on Tuesday reportedly cancelled a U.S. cargo from Cameron LNG in Louisiana. The move is reflective of the tough decisions offtakers must make when demand is tepid and storage is full. Pavilion has a long-term, take-or-pay supply deal with Japan’s Mitsubishi Corp., one of the Cameron project’s sponsors.

“With winter demand picking up, the timing of the cancellation comes as a surprise and adds to concerns around LNG shut-ins next spring amidst a global LNG glut,” Tudor, Pickering, Holt & Co. (TPH) analysts said.

Despite being competitive globally on a full-cycle basis, due to the tolling structures they employ, U.S. LNG projects carry some of the highest variable costs, according to TPH. By separating upstream procurement costs from the liquefaction toll, gas sourcing costs become a variable cost for offtakers, compared to most global projects that are integrated with very low variable costs.

With Japan Korea Marker and European Title Transfer Facility trading around $6.00/MMBtu and $5.00/MMBtu, respectively, “there appears to be sufficient margin currently to justify gas sourcing costs, but floating storage has been pushing up charter rates recently, which may be partially responsible for the cancelled cargo,” TPH analysts said.

Indeed, several cargoes have been used for floating storage, while others have lingered at sea waiting on higher prices to materialize this winter, both of which have contributed to heightened shipping rates that are expected to persist through the rest of the year.

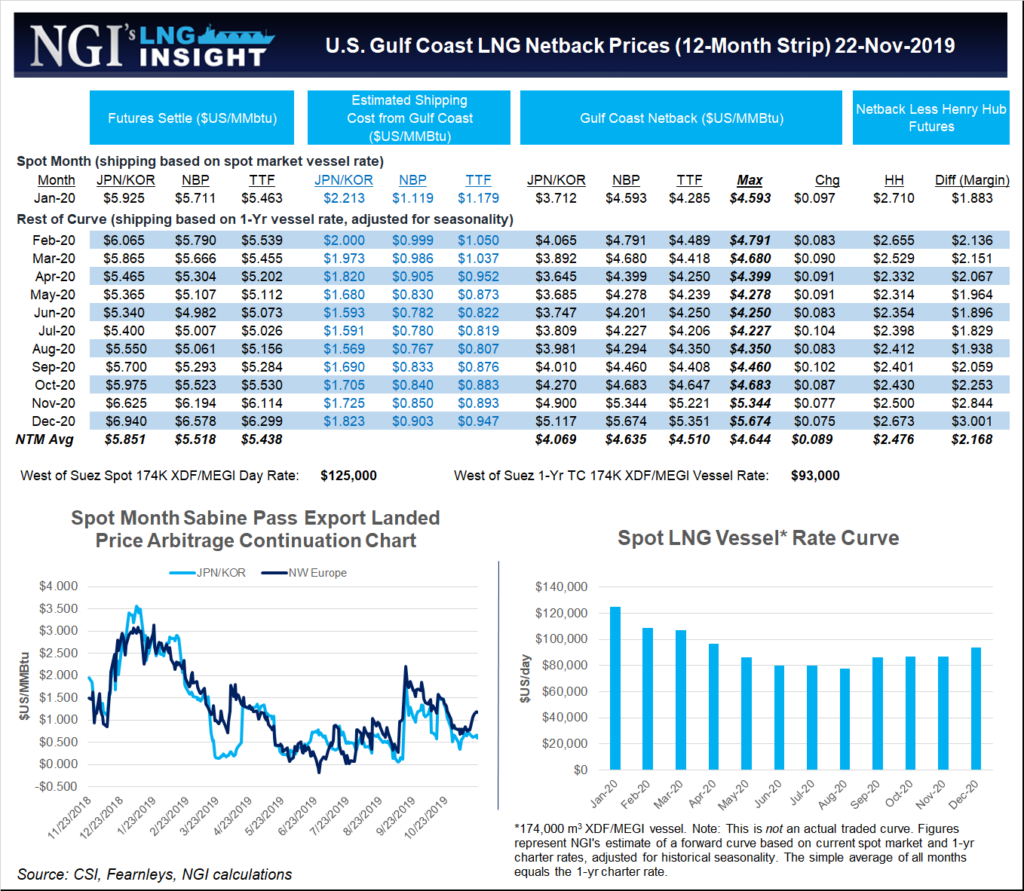

“We estimate the current margins to move spot market LNG cargoes from Sabine Pass to Europe (specifically the Gate terminal in the Netherlands) and Tokyo are roughly $1.15/MMBtu and $0.65/MMbtu, respectively,” said Patrick Rau, NGI‘s director of strategy & research.

NGI began publishing arbitrage spreads from Sabine Pass to Europe and Asia, along with other key information such as LNG netback pricing in the U.S. Gulf Coast, and Asia oil parity pricing in its nascent LNG Insight service last month. The daily pricing, data and news service targets the North American LNG market.

In actuality, that European margin may be a bit on the high side, Rau said, since it is a delivered-to-terminal price.

“The Title Transfer Facility (TTF) prices upon which that calculation is based is a delivered-to-pipeline price, so one may need to deduct another 10-40 cents to get the true variable costs of regasifying the LNG, and injecting it into the pipeline grid, and include those in the spread calculation,” Rau said. “But even with those, the European arb from Sabine Pass is still there.”

Cargoes delivered to Asia typically change hands en route, and therefore are unaffected by regasification and downstream pipeline access charges, Rau explained.

But while gross margins from the U.S. Gulf Coast to Asia and Europe are both sufficiently positive right now, Rau questioned whether there is truly a demand for more shipments from the United States given the current global supply glut, saying “I’m not so sure.”

Cameron LNG, which had no comment on Pavilion’s decision to cancel its cargo, said it continues to operate “without restriction to meet the cargo loading schedules agreed with our customers.”

European storage has played the biggest role in bringing balance to the global gas market this year, but storage facilities are bursting at the seams and demand projections are rather dismal for what is expected to be a mild winter.

Aggregate storage stocks in Europe are currently sitting at about 101 billion cubic meters (Bcm), which represents 98% of working capacity, according to data compiled by Gas Infrastructure Europe. The firm’s sample includes 32 storage system operators with around 102 storage sites in 19 countries in Europe, representing approximately 91 Bcm, or 84% of European Union technical storage capacity.

The current storage overhang was borne out of storage facilities exiting the 2018-2019 winter with above-average inventories in stock, and was exacerbated by a glut of LNG supply hitting the market throughout the summer, dropping prices and disincentivizing exports to other demand centers.

However, what has really underpinned the high injections over the last year in Europe is the uncertainty over whether Ukraine and Russia would come to an agreement on a new transit contact, according to Wood Mackenzie. Their current contract expires at the end of the year, and the two countries have yet to formalize a new agreement.

In a nutshell, “Ukraine wants to secure a long-term gas deal with Russia”, even as it plans to build at least four LNG import terminals within the next five years to help diversify its supply, Douglas said. Russian giant Gazprom “wants more flexibility in its contracts as far as flows and duration.”

The uncertainty over whether a new transit deal will be reached “has kept the forward curve high enough to incentivize European players to put as much gas in storage as possible,” Douglas said.

To be sure, storage supplies would become a critical factor if a deal between Ukraine and Russia is not reached. In the worst-case scenario, there would likely be one or two markets to face some challenges in the event of cold snaps, according to Wood Mackenzie.

“There has been a huge emphasis on interconnection. We have lots of storage. We believe the market can balance. But it would certainly lead to an uptick in prices,” Douglas said.

However, Wood Mackenzie and other analysts believe an agreement will be announced before the end of the year, pushing already low prices even lower and threatening a number of suppliers.

“The probability is that we’ll have a lot more gas in storage than we did last year,” Douglas said. “At the same time, Europe will have to import even more LNG next year than it did in 2019” as prices in other demand centers like Asia remain weak.

Wood Mackenzie projects Europe will exit the winter withdrawal season with 45 Bcm still in storage under normal weather conditions, which compares to the five-year average of 40 Bcm. “If we have a mild winter, that could be up toward 54 Bcm,” Douglas said.

Independent market design and regulatory expert Alex Barnes, who previously served as the head of regulatory affairs for more than seven years at Gazprom Marketing & Trading Ltd., said Europe’s healthy storage levels are “another great example” of how much the region’s market has changed due to the liberalization of the natural gas market.

“People have responded to price signals and put gas into storage,” Barnes said. “All this LNG has come to Europe because LNG suppliers find it easier to sell cargoes into Europe. That benefits Europe as far as low gas prices, but also in terms of security of supply because it can put it into storage.”

Europe is in a much better position than it was a few years ago because there is a lot more physical interconnection between the different national markets, and the rules ensure gas can flow more easily between the markets, according to Barnes. “So everybody can benefit from high levels of storage.”

The robust storage levels also provide some cushion for declining production in Europe. Production at Europe’s largest natural gas field, Groningen, has been in decline for years, and the Dutch government is set to shut the field entirely by mid-2022.

Therefore, Wood Mackenzie sees gas demand, and LNG demand in particular, remaining resilient through the 2030s, climbing an additional 180 million metric tons (mmt).

“What would give us more confidence is if we see more growth in Asian markets,” Douglas said.

At the same time, 2020 is shaping up to be another banner year for new LNG projects, with Wood Mackenzie estimating another 60 mmt/year being sanctioned. This compares to the more than 63 mmty that has been sanctioned so far in 2019, including the Golden Pass and Calcasieu Pass terminals and the sixth production unit at Sabine Pass, all in the United States.

With U.S. projects expected to make up a significant portion of new developments moving forward in 2020, Wood Mackenzie expects more American cargoes to land in Europe in 2020, with the U.S. climbing to “a more definitive number two position” in global exports behind Qatar.

However, BP plc’s chief financial officer, Brian Gilvary, citing the dismal outlook for global gas prices, warned that not all the planned export projects may move forward.

Speaking on the company’s third quarter earnings call, the executive said, “…you will see some gas exports,” but he was unsure exports would be “anywhere near the capacity” that has been built to date.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |